Comments from Guy Barnard, Co-Head of Global Property Equities and Portfolio Manager; Tim Gibson, Co-Head of Global Property Equities and Portfolio Manager; and Greg Kuhl Portfolio Manager at Janus Henderson Investors.

The root cause of the recent downdraft in markets appears to be the escalation of rhetoric around tariffs and the potential economic impact of workforce reductions in the US federal government.

What does this have to do with commercial real estate fundamentals? The answer, we believe, is likely very little.

Of course, commercial real estate (CRE) fundamentals are not completely immune from an economic recession. In this scenario, we’d expect to see an uptick in tenant defaults and a slowdown in tenant decision making, which would likely result in lower occupancies and rents over time.

However, we do think commercial real estate has some benefits vis-à-vis other sectors of the economy that are worth revisiting.

Lower levels of uncertainty

As real estate investors we don’t need to estimate how many units of our product consumers will buy this year, whether our suppliers will increase input prices for the goods we produce, whether our key drug will be approved, or whether new tech will come along that makes our hardware or software obsolete.

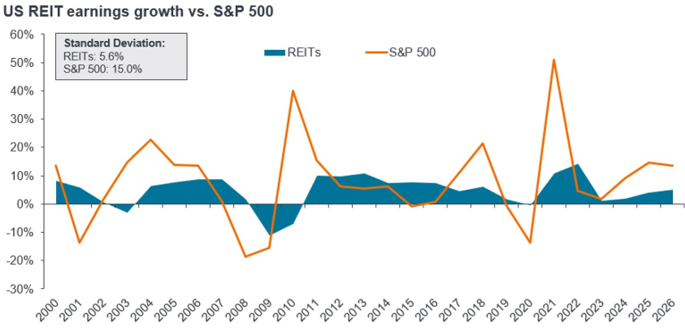

Commercial real estate operates based on legally contractual leases where future cash flows are highly predictable. High quality real estate typically attracts high quality tenants, which tend to meet their obligations – we saw this even during COVID when tenants continued to pay rents even when they weren’t there. This dynamic is borne out in the standard deviation of real estate investment trust (REIT) earnings, which is roughly one third that of the S&P 500.

REIT cash flows less volatile than broader equities

Incumbent landlord strength

Tariffs might weigh on the economy, but the number one enemy of a high quality CRE landlord is new supply that tries to poach tenants. If building materials like steel and lumber become more expensive, and if deportations shrink the construction labour force, making labour more expensive, the cost to build will go up. This creates an additional hurdle for developers, which is good news for incumbent landlords like the listed REITs we invest in.

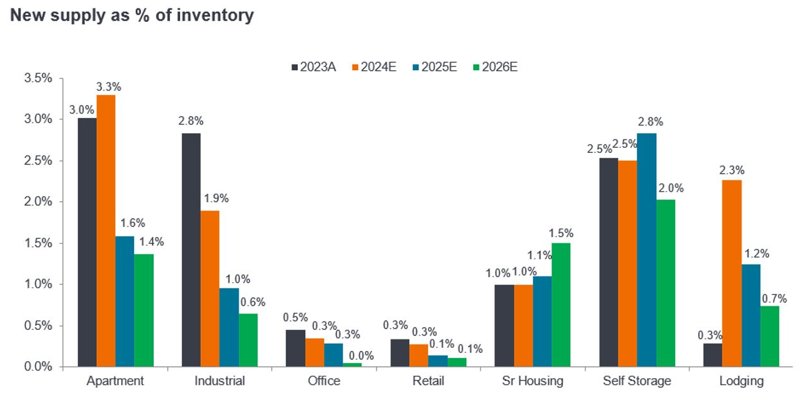

The supply backdrop was already looking supportive (see below) with the brakes having been hit on new construction in many sectors in 2022/23. This benefit should feed into landlords pricing power in the years ahead, notably in sectors such as industrial/logistics and apartment.

Supply outlook increasingly supportive

Declining new supply reflecting higher cost of capital and construction

Flexibility to reposition

A benefit that is only enjoyed by listed REIT managers and not by their private real estate brethren is the ability to seamlessly reposition portfolios in response to new information. For example, we track 17 different property types within CRE. Some of these are longer duration and more defensive in nature (think healthcare, net lease, data centres), while others see their fundamentals respond much more quickly to changes in the economy (hotels, storage, apartments). We can reposition our portfolios in a matter of days, which is a deeply underappreciated benefit of the listed REIT asset class.

Opportunity in volatility

What is an investor to do with the seemingly conflicting ideas that CRE fundamentals are stable, but equity markets are volatile? We believe volatility creates opportunity for investors – with the investors we serve having time frames measured in years rather than weeks or quarters. With this in mind, the current situation in equity markets creates two specific types of opportunities:

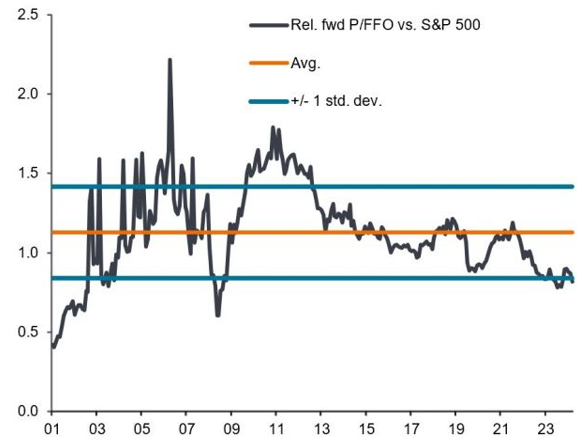

1 – Although REITs have outperformed the S&P 500 year-to-date, they too have declined, and they started the year at close to historically large discounts to the broad market. Investors seemingly haven’t had much interest in “defensive growth” for several years, but perhaps this will now begin to change.

In our opinion, REITs’ relative valuations makes them attractive in a healthy macro environment, but maybe their defensive characteristics make them even more attractive in an uncertain one.

Real estate has de-rated vs broader equities

S&P 500 Real Estate forward P/FFO versus. S&P 500 forward P/E

2 – The current market sell-off appears to be somewhat technical in nature, especially as it relates to the idea of hedge fund “de-grossing”. To us, this sounds like an inefficiency in the market. We believe it is happening in REITs, and, in our view, presents an opportunity to take advantage of by acquiring shares of high-quality REITs at discounted prices.

The pace of news flow and swings in equity markets this year have been frenetic, bordering on exhausting, and it’s only late March. Real estate can sometimes be seen as a slightly boring asset class, lacking the headline-grabbing attention of other sectors. But against the current backdrop of a more volatile and uncertain macro environment, perhaps being steady and boring is a positive quality to have.

So, while it’s tempting to get caught up in the daily excitement of the news cycle and accompanying market turbulence, we would advise not turning the plane around, but instead focusing on the destination and looking for a less bumpy route to get there.