Council Rates Surge 39% — The ‘Silent Mortgage’ Squeezing Homeowners

11 February 2025

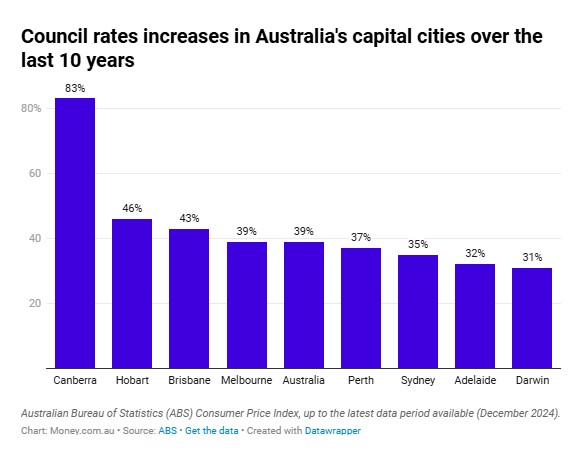

While interest rates remain a hot topic in Australia, little attention has been given to a rising cost homeowners are grappling with — council rates. Over the past decade, property rates have surged by 39% nationally, according to data analysed by Money.com.au.

This means council rates have outpaced inflation, which increased by 30.8% over the past decade.

The data shows some capital cities have seen even steeper rises than others. Canberra homeowners were hit the hardest, with council rates nearly doubling over the past decade — surging by 83%. Hobart property owners faced a 46% increase, while those in Brisbane saw rates climb 43%. In Melbourne, council rates rose in line with the national trend at 39%, while Sydney homeowners experienced a slightly lower increase of 35%, according to inflation data from the ABS.

Council rates outpace other housing costs, but not rents

Nationally, property rates and charges have seen the highest price increase of any property-related expense for homeowners, rising 4.9% in 2024 — outpacing costs of maintenance and repairs, utilities and other housing expenses. The only expense rising faster was rent, which increased by 6.4%, according to ABS data.

Money.com.au’s Property Expert, Mansour Soltani, says council rates are a growing concern among homeowners.

“Council rates have crept up faster than almost any other housing cost, acting like a ‘silent mortgage’ that homeowners can’t exactly shop around for or negotiate. Rising property rates coupled with high interest rates on mortgages have created a double financial squeeze, making homeownership increasingly unaffordable for many Australians,” he says.

“Our recent survey found that 18% of Aussies ranked council rates as their most dreaded bill, placing them ahead of insurance premiums and childcare costs. This highlights just how much of a financial strain they’ve become for homeowners.”

Money.com.au’s Data & Research Expert, Peter Drennan, says council rates typically increase once a year, often reflected in the September quarter.

“Most local councils set their budgets and determine new property rates for the financial year ahead. Any rate changes – and they’re usually increases – typically come into effect from July 1, meaning homeowners start seeing the impact in their September quarter bills,” he says.

According to CPI data, council rates increased by 4.9% annually in the September 2024 quarter, with no further change for the December 2024 quarter. This means the annual growth rate of 4.9% will remain steady for the next half-year, until the index is updated again in September 2025.