First-home buyers need a 99% bigger deposit to buy the average home in 2024

25 September 2024

Data analysed by Money.com.au reveals first-home buyers now need to save a 99% bigger house deposit compared to 12 years ago — when official property price records began.

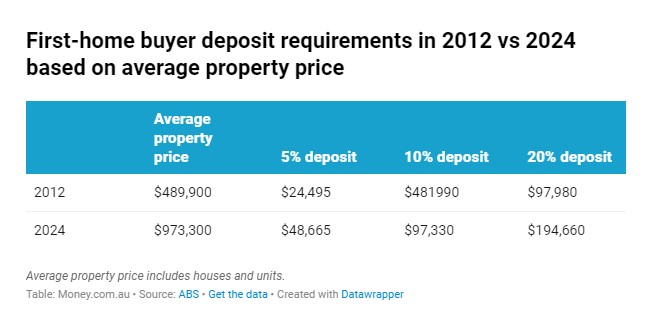

Since the ABS began measuring dwelling values in Australia, the average property price has surged by 99% — from $489,900 in 2012 to $973,300 in 2024.

Back in 2012, a first-home buyer would have needed $48,990 for a 10% deposit, while today that figure has nearly doubled to $97,330 — a 99% bigger deposit. For homebuyers wanting to avoid lender’s mortgage insurance (LMI), a 20% deposit in 2012 would have been $97,980, whereas today it’s $194,660.

Additionally, salaries have not kept pace with property prices. In 2012, the average Australian earned $70,158, while in 2024, the average full-time worker is earning $100,016 — only 42% more.

“The affordability gap for first-home buyers has widened dramatically, making saving for a deposit a near-impossible task,” says Money.com.au‘s Home Loans Expert, Mansour Soltani.

“The subsequent jump in deposit requirements is forcing many first-home buyers to either delay homeownership or find alternative financing methods, like borrowing from the bank of mum and dad, or using guarantors and government support.”

Money.com.au also compared the average loan size taken out by first-home buyers over the last 12 years with the average property price during the same periods to determine the gap between the two.

In 2012, the average first-home buyer (FHB) loan covered 73% of the average property price in Australia. However, with rising property prices and higher interest rates, today’s average FHB loan only covers 65% of the average house price.

“This tells us the average Australian first-home buyer either needs to come up with a larger deposit or settle for a cheaper property — both of which are increasingly difficult to do in 2024,” says Money.com.au‘s Research & Data Expert, Peter Drennan.

According to Peter, while FHB loans are growing three times faster than the overall loan market, buying an average home is now harder than ever.

Other first-home buyer loan insights:

In July 2024, there were 10,937 new FHB loans, with one in three coming from Victoria, which experienced a 24% increase for the month. This was second only to Queensland, which saw a 29% year-on-year rise.

Despite rising property prices and interest rates, FHB loans are growing three times faster than the overall owner-occupier loan market. FHB loans now make up 31% of the home loan market.