2024 on track to be a better year for commercial property investors, as predicted

18 April 2024

2024 is on track so far to be a better year for prospective commercial property investors, according to the latest research from Knight Frank.

The real estate consultancy’s Australian Horizon 2024 report, released in November last year, predicted that the new year would bring better times for investors looking to acquire assets after a prolonged pause in the market and falling valuations during 2022-23.

With the first quarter now completed, Knight Frank’s Horizon 2024 report update, entitled Window opening as twin gaps close, has found this prediction to be firmly on track to coming to fruition this year due to three key developments:

- The macroeconomic backdrop has become decidedly more favourable

- Bid-ask spreads are narrowing, with the gap between buyer and seller expectations getting smaller

- The outlook for relative returns across asset classes has shifted, effectively closing the second gap that has impacted sentiment over the past two years – the gap between pricing in public markets and slower moving private markets

Knight Frank Chief Economist Ben Burston said a window for commercial property investors was opening amidst an improvement in the macroeconomic backdrop, and the narrowing of two gaps that have prevailed over the past two years – the gap between purchaser and vendor pricing expectations and the gap between the valuations implied in private versus public markets.

“Since October, inflation in the major global economies has fallen substantially, and as each month passes we are getting closer to a turn in the interest rate cycle, with Europe leading the way in shifting to rate cuts,” he said.

“In Australia forward rates currently imply that the cash rate will drop by around 50 basis points by end 2025, and many forecasters are much tipping larger reductions.

“In addition, substantial progress has been made to narrow the first of two wide gaps that have prevailed since early 2022 – that between buyer and seller expectations – with valuations falling further in Q4.

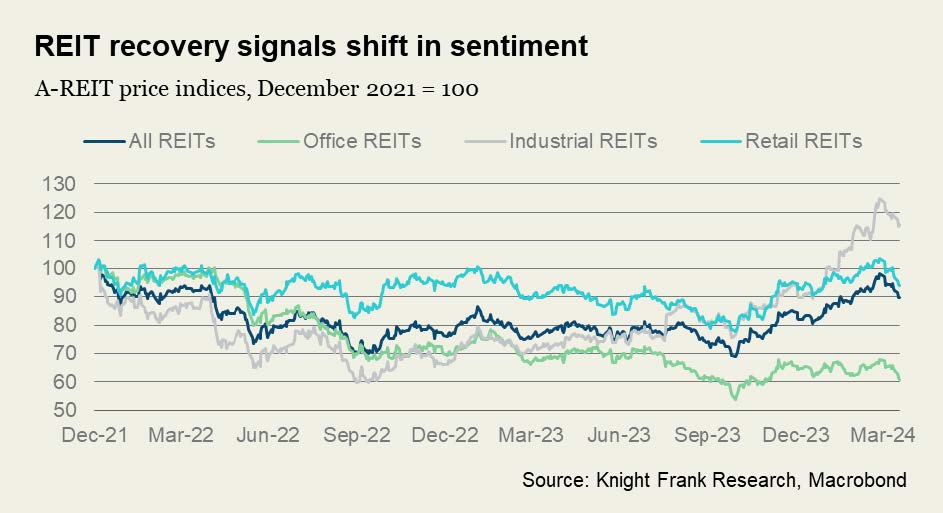

“Finally, the outlook for relative returns across asset classes has shifted, with the shift to a more dovish posture on the outlook for base rates generating a strong rally in bond and equity markets globally, with Australian REITs mounting a strong comeback.

“This has effectively closed the second gap that has impacted sentiment over the past two years – the gap between pricing in public markets and slower moving private markets.

“More broadly, as prices in fixed income and equity markets have surged, while property values have continued to correct, the relative risk-return equation offered by different asset classes looking forward is changing.

“During 2023, few were willing to deploy additional capital to real estate, but as pricing adjusts the outlook is looking more favourable on both an absolute and relative basis.”

Mr. Burston said the three key developments taking place in the market this year would start to entice investors back.

“After an extended period of inactivity, major domestic institutions and cross border investors will be reappraising the outlook and some will choose to flick the switch back to acquisition mode,” he said.

“In addition, pent up demand from both investors and vendors to trade and reposition their portfolios continues to build and as the level of uncertainty around the outlook eases and downside risks dissipate, a deeper pool of assets will come to market.

“This is not to say that it will all be smooth sailing. The adjustment of formal valuations has still not entirely played out and will remain a brake on activity for the time being.

“And the macro outlook, while much more favourable than a year ago, is still uncertain and the ‘last mile’ of the inflation fight may prove stubborn, impacting the willingness of the RBA to change tack.

“But as time goes on, it will become apparent that the risks are two-way. Buyers waiting for the full suite of economic and pricing indicators to switch from red to green may end up waiting too long.

“History suggests that property markets can move quickly, and the best buying often comes hot on the heels of a downturn, as evidenced by the returns generated by the early movers who shifted into acquisition mode in late 2009.”