Welcome to this weeks Property News.

It was great to see Victorian’s back out of lock down this week. We all hope that COVID19 will be contained as we move into the important Christmas trading period for small businesses.

The ASX REIT market suffered a major fall this week (down -3.5%). A number of factors were at play with most of the falls felt by Shopping Centre owners, SCentre (down -7.5%) and Vicinity (down -8.7%).

Even though Shopping was once again permitted in Victoria and sales results have been on the improve, the markets were spooked by the ongoing low rental collections rates announced by the REITs this week. GPT received 81% of retail rental in the July Quarter, Mirvac just 64%, Shopping Centres Aust 78%, and Stockland approximately 81%.

Also hurting the sector has been the ongoing demise of Myer with announcements this week that it’s Chairman was forced to step down by Solomon Lew (one of its largest shareholders) who also called for the whole Board to resign. It was also reported that Myer was in new talks with landlords to reduce floor space by at least another 60,000sq m with 21 stores likely to close in the next eight years.

Mosiac Brands (owners of Noni B, W.Lane, Katies, Autograph, Rockmans, Crossroads, beme and Rivers) confirmed the closure of 73 stores this year with another 250 to close at the end of the year (out of 1300).

All of these announcements were a reminder that discretionary retailing in larger Shopping Centres has a long long way to go.

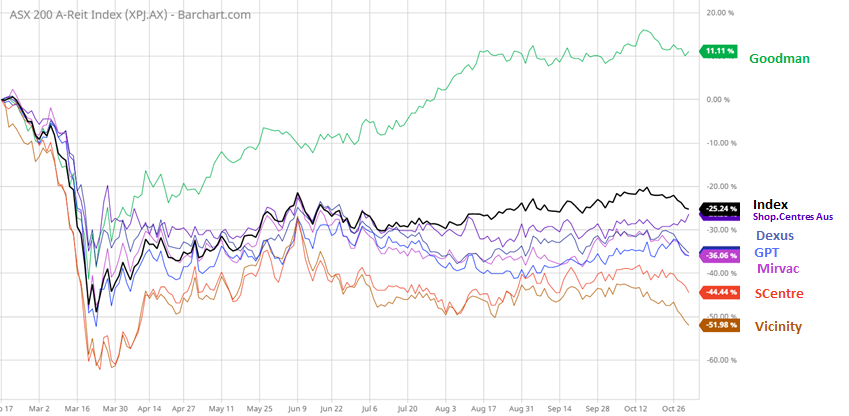

A quick look (see chart below) at the comparative performance of the major AREITs since COVID began shows the stark difference between the stocks exposure to discretionary expenditure and one focused purely on industrial & logistics.

Late this week, APRA released an update on Australian Household deposits which have now surged to $1.09 trillion as at the end of September, a significant buffer against the COVID-19 recession, and a sign that households will be ready to spend again once there is some further confidence in the jobs market. Retailers will be scrambling to get stock on the shelves and hoping that COVID and the Government don’t raise their head again anytime soon.

The return of the Palaszczuk Government to lead Queensland came on Saturday, with an increase in support for the Labor party who used border lock downs as a political tool during the campaign. We hope now that the election is over that the borders will be opened up further to allow more people to support business and tourism in the state.

Overall, our investment views haven’t changed we continue to favour investment or development property underpinned by long term secure tenants who rely on non discretionary consumer expenditure. These include neighbourhood convenience retail, medical & health facilities, education and child care services, fuel & automotive services. We are cautious on CBD office, hotels, regional and major regional shopping centres but expect there will be opportunistic buying in office and retail sectors to watch for.

In the week ahead we will get news on inflation and the latest Interest Rate decision by the RBA.

Until next week.

Warwick