The HealthCo Healthcare and Wellness REIT have reported a 4% gain in valuations across 27 properties in their portfolio.

HCW Senior Portfolio Manager Sam Morris, said: “HealthCo continues to deliver against its core objective to provide investors with stable and growing income from a diversified healthcare portfolio underpinned by favourable long-term megatrends.

The revaluations comprised 13 independent valuations representing 48% of the properties by number with the remaining 14 properties completed by internal valuation.

The valuations, which remains subject to year-end audit, have increased by $47m million (+7.8%) to $647 million (from 31 December 2021 to 30 June 2022). Net of capital expenditure incurred during the period of $22 million, this represents a net valuation increase of $25 million (+4.1%).

“We have continued to unlock the significant embedded value in our portfolio and development pipeline where we can generate attractive total returns. HealthCo has the potential to significantly grow its net operating income over the medium-term through the successful delivery of its committed development pipeline, the previously announced acquisitions and increased occupancy across the portfolio.”, said Mr Morris

Preliminary unaudited portfolio valuation Independent valuations ($m) Internal valuation ($m) Total ($m) Portfolio WACR % # of properties 13 14 27 31 December 2021 valuation 379 221 600 5.11% Capital expenditure 6 16 22 Net valuation increase 25 – 25 30 June 2022 valuation 410 237 647 4.94% Gross increase +8.2% +7.2% +7.8% Net increase +6.5% +0.1% +4.1%

HCW Chief Financial Officer Christian Soberg said: “The preliminary unaudited valuation result provides strong validation for HealthCo’s high quality and well-located portfolio which is benefitting from strong investor appetite for the healthcare sector and healthcare tenant demand. The portfolio continues to perform with 100% unadjusted cash rent collection since listing. Finally, we reaffirm our FY22 FFO per unit guidance of 5.0 cents.”

ACQUISITIONS

- Settlement of the previously announced $108m portfolio acquisition of 13 newly developed metro-located childcare centres continues to progress.

- As at 3 June 2022, 4 centres have settled with a further 2 on-track to complete by the end of FY22.

The remaining 7 centres are scheduled to settle in FY23.

- The capitalisation rate of 5.0% for HCW’s recent childcare acquisitions compares favourably to market observed pricing for metro-located assets on long term leases with national tenants.

DEVELOPMENT UPDATE

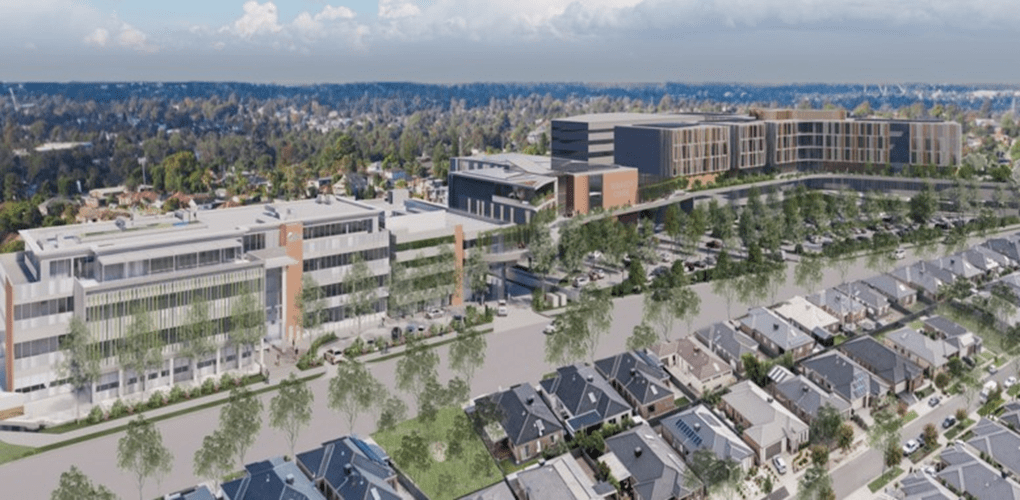

Camden Stage 1 – The George Private Hospital (NSW)

- The George will be a new 783 bed private hospital, operated by Acurio Healthcare Group, specialising in paediatrics and maternity to address the unique needs of young families in the Camden catchment.

- The development of The George, under a fixed price D&C contract, is on schedule and on track for completion in early CY23.

- The project is on track to achieve its target ROIC in excess of 5%.

Springfield (QLD)

- Pre-commitments at HealthCo’s integrated health hub at Springfield have increased to 99% and construction is well advanced.

- The pre-commitments have supported a material independent valuation increase of $10.8m.

- 57 overnight beds and 21 day beds

- Including signed MOUs.

Proxima (QLD)

- The Proxima health hub development in the emerging Gold Coast Health and Knowledge precinct is well progressed, and broadly in line with the estimated completion date of mid CY2023.

- Pre-commitments exceed 65%, including from the Queensland Government, Griffith University, Sanctuary Early Learning, Mater Pathology and Queensland’s first privately owned integrated Cancer Imaging and Therapy Clinic (CITC).

Ballarat (VIC)

- Occupancy at HealthCo’s integrated health hub in Ballarat has increased to 99%5, an increase from 85% occupancy as reported in the H1 FY22 announcement.

- The occupancy increase has supported a independent valuation increase of $6.3m.

- Including signed MOUs.

NEW DEVELOPMENTS – CAMDEN STAGE 2 (NSW)

- HealthCo is developing an integrated Heath and Innovation Precinct in Camden. Camden is one of Australia’s fastest growing LGAs, with the Precinct being developed to provide much needed integrated health care infrastructure to Sydney’s south west growth corridor.

- Stage 2 of the Precinct is a general private hospital to complement The George. Discussions with leading national hospital operators are ongoing and detailed planning and design for stage 2 is progressing well.

JUNE 2022 DISTRIBUTION DECLARATION

HCW Funds Management Limited as Responsible Entity of HCW has declared the quarterly distribution for the period 1 April 2022 to 30 June 2022 of 2.25 cents per unit.

The distribution is consistent with the forecast FY22 annualised distribution yield provided in the Product Disclosure Statement for HCW dated 2 August 2021.

A Distribution Reinvestment Plan (DRP) is in place and activated for this quarter with no discount. The key dates and details for the June 2022

Premium Members can find all HealthCo Healthcare and Wellness REIT Articles, trading Analysis, Annual Reports and Presentations here