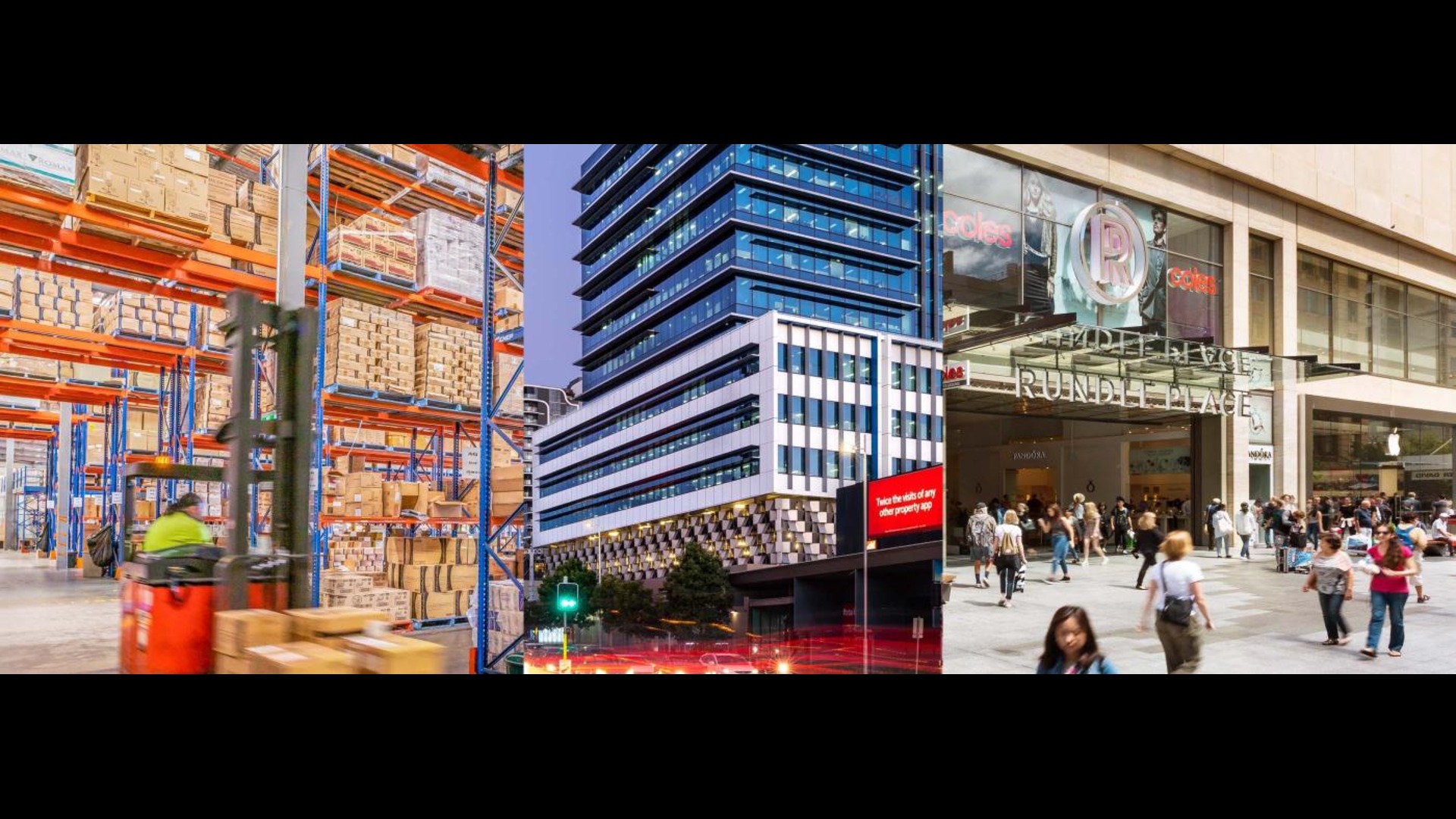

Growthpoint announced today a fully underwritten capital raising of $150m to support its new opportunities despite maintaining gearing below its target range. The fresh capital will be used to: Support Growthpoint to continue delivering on its strategy of acquiring well-leased, well-located commercial real estate while maintaining gearing near the lower end of its target range of 35% – 45% Provide capacity to acquire a modern building located in metropolitan Sydney for approximately $50 million, in respect of which Growthpoint is in advanced stages of due diligence. If this acquisition proceeds, settlement is expected to be in late August 2019 Provide additional funding for Growthpoint’s internal development and expansion opportunities, which include a new 19,300sqm office building in Richmond, VIC; an expansion of the Woolworths Distribution Centre in Gepps Cross, SA; and a new opportunity being progressed involving the redevelopment of an industrial site of 25 hectares in Broadmeadows, VIC (pictured above) previously occupied by Woolworths. The capital raising is based on an issue price of $3.97 per security which represents a: 4.2% discount to the distribution-adjusted last closing price of $4.14 on 26 June 20191 5.4% discount to the distribution-adjusted 5-day volume weighted average price (“VWAP”) of $4.20 on 26 June 2019 6.0% FY20 DPS yield. The capital raising is expected to have the following financial impact: No material impact on FY19 FFO per Security guidance of at least 25.0 cents and declared FY19 DPS of 23.0 cents respectively Pro forma gearing of 31.6% 2 , below Growthpoint’s target gearing range of 35% – 45% Pro forma net tangible assets (“NTA”) increased to $3.37 per Security from $3.36 per security at 31 December 2018, prior to the conclusion of the current year-end revaluation process FY20 guidance, including the impact of the Placement, of FFO per Security of at least 25.4 cps3 and DPS of 23.8 cps3 representing 3.5% growth on declared FY19 DPS Growthpoint also advised that 27 of its 57 properties, representing 46% of total portfolio value, are currently being independently valued as at 30 June 2019. Draft valuations indicate positive yield compression and rental growth across the property portfolio with growth in valuations on a “like for like” basis. Final valuations will have Directors’ valuations applied and will be announced with the Group’s full year results for the year ending 30 June 2019. Growthpoint also confirmed that ANZ has exercised its option and will enter into a new 6-year lease at its South Melbourne, VIC office, representing 13,744 sqm or 2.3% of total portfolio income. #Growthpoint