Six key themes are set to play out in Australia’s capital markets over 2025 as the market continues to recover, according to the latest Knight Frank research.

The firm’s Knight Frank’s Australian Capital View report found capital markets were growing more confident now that valuations have reached a cyclical low.

“Asset prices have returned to growth across all sectors as cross-border capital flows accelerate,” said Knight Frank Senior Economist, Research and Consulting and report author Alistair Read.

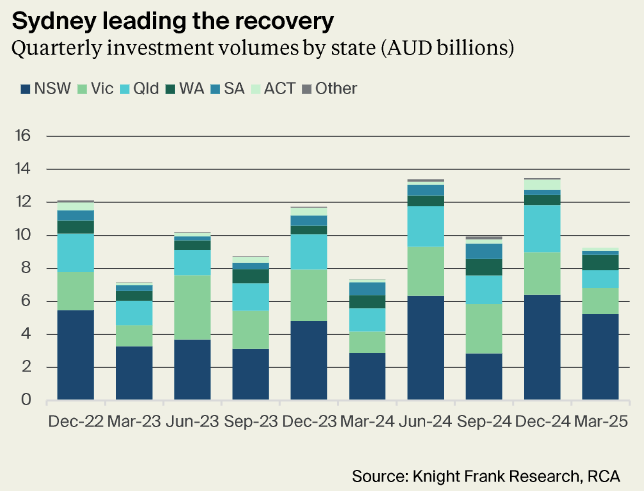

“Transaction volumes have continued to rise, reaching $9.3 billion in Q1 – a 26% rise compared to Q1 2024 – and establishing baseline prices that will help unlock further investment activity in 2025.

“A wide range of groups are now looking to deploy capital in the near-term to take advantage of an attractive entry point and maximise the prospect of long-term capital growth, which has led to a pick up in demand for prime product in the core office, industrial and retail sectors, where investors are able to deploy capital more quickly.

“At the same time, many are seeking to deploy into less liquid alternative sectors, particularly build-to- rent, student accommodation and data centres, but these strategies will take longer to execute.

“As the year goes on, improving liquidity and prospects for further cuts in interest rates will continue to unlock capital markets and we expect the current momentum to be sustained.”

As growth continues in capital markets, Knight Frank expects to see six key themes to play out in the market for the remainder of the year:

6 key themes for Australia’s capital markets in 2025 1. Sydney and Brisbane leading the recovery 2. Real estate portfolio weightings to rise 3. Shift in market conditions favours tilt back to equity over debt strategies 4. Australia less exposed to tariff risks, but overseas investors may take a pause 5. Strong demand for retail but sector specialists will dominate transactions 6. Election result will prompt further development activity in living sectors

Theme 1: Sydney and Brisbane leading the recovery

Core assets in Sydney and Brisbane are expected to lead the recovery as the market returns to growth.

Knight Frank Chief Economist, Ben Burston said: “As Australia’s deepest and most liquid capital market and its most international city, cross-border investors consistently highlight Sydney as a key target within the APAC region. Brisbane is also in favour given the strong economic growth story of South East Queensland, substantial infrastructure investment and continued rental growth across multiple sectors.”

Theme 2: Real estate portfolio weightings to rise

Over the past three years, some institutional investors have sought to reweight to lower the proportion of real estate within their overall asset allocation strategy given the cyclical downturn and strong rally in equity markets.

“However, with the market returning to growth and equity valuations still elevated, investors will once again be turning to direct property investment,” said Mr Burston. “This will support capital raising as real estate resumes its role as a critical component of institutional capital allocation, with the renewed promise of low volatility alongside significant long-term growth potential as capital values recover from the recent cyclical low.

Theme 3: Shift in market conditions favours tilt back to equity over debt strategies

During the downturn, falling asset values and high and rising interest rates provided sound reasons to allocate into debt strategies and the market saw an increase in the number and scale of funds providing credit.

“However, as the market shifts back to growth off the back of falling interest rates, this will moderate some of the drivers behind the expansion of debt strategies and will tilt the balance back to equity investment,” said Mr Burston. We expect this to result in an improved environment for capital raising focussed on both core assets in traditional sectors and development in living sectors.”

Theme 4: Australia less exposed to tariff risks, but overseas investors may take a pause

Australia is relatively well placed to withstand tariffs, with little direct exposure to US trade, however, a slowdown in global growth does pose some risks to the outlook.

“The recent uncertainty may see a temporary slowing in deal momentum over the next few months as major offshore investors opt to wait-and-see how events unfold,” said Mr Burston. “However, looking further ahead the comparative stability of Australia may see more international investors focussing on Australia if they divert attention away from the larger US market.”

Theme 5: Strong demand for retail but sector specialists will dominate transactions

After a challenging period, the outlook for the retail sector is increasingly positive with real incomes returning to growth, turnover and leasing spreads in the major centres on an upward trajectory, and improved investor sentiment as macro headwinds ease.

But despite rising interest from a broad range of investors, Knight Frank expects retail specialists will remain the dominant buyers of retail assets.

“Non-specialists face several hurdles compared to local specialists including reduced leverage in rental negotiations and higher facility management costs,” said Mr Burston.

Theme 6: Election result will prompt further development activity in living sectors

After a challenging period for developers, we are new seeing a pick-up in activity, with around 6,900 student beds under construction and an estimated 8,900 build-to-rent (BTR) apartments under construction nationally, plus a further 20,000 BTR apartments approved for development over the next five years.

“The recent election result will reinforce this momentum and means recent policy measures to support development will remain in place, most notably the reform of the managed investment trust framework to reduce the withholding tax rate for BTR investment to 15% in line with other sectors,” said Mr Burston.