2025 to Be the Second Record Year of Supply for BTR, before a Delivery Drop-off in 2026

18 August 2025

2025 is shaping up to be another record year of supply for the build-to-rent (BTR) sector, according to the latest research from Knight Frank.

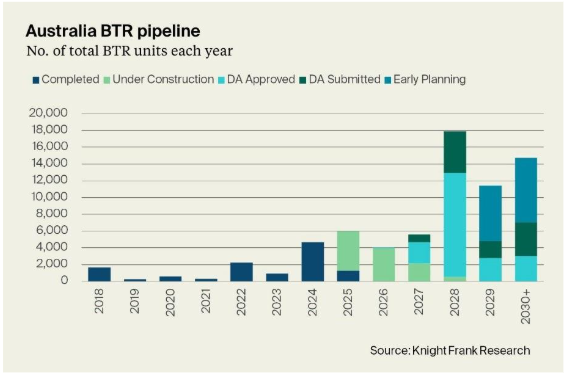

The firm’s Australia Build to Rent Update Q3 2025 found that the record year of supply in 2024, which saw 4,660 units delivered across 18 schemes nationally, was forecast to be eclipsed this year, with 6,000 units to be delivered.

Since the start of 2025 four BTR schemes have opened, adding 1,298 units to the total operational stock.

Two of these have been in Melbourne – Claremont Tower and Madison Grand – further reinforcing the city’s position as the national leader in BTR delivery to date.

The remaining two, Arklife Cordelia and Liv Anura, opened in Brisbane, where interest in the asset class continues to grow amid tightening rental conditions.

Knight Frank’s database shows a further 4,702 units earmarked for completion in the second half of the year across 12 schemes, taking annual delivery to 6,000 units.

Since 2018, 11,944 BTR units have been delivered, with a further 11,368 units currently under construction nationally. A further 47,033 units sit at various development approval stages or in early planning.

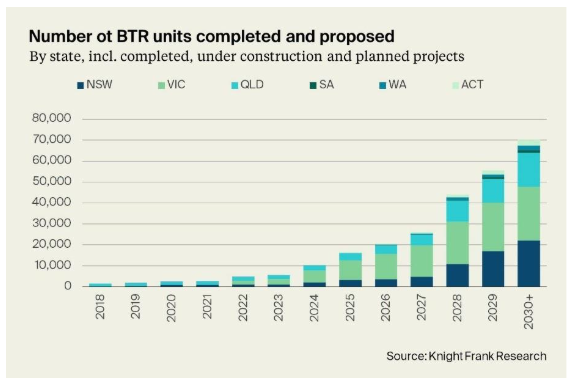

The BTR pipeline is most advanced in Victoria, followed by New South Wales and Queensland. To date Victoria has seen 13,198 BTR units either completed or under construction, with another 12,632 in the pipeline totalling 25,829.

In Queensland, 4,157 units have been completed or are under construction, with another 12,122 in the pipeline to total 16,279.

New South Wales has 5,335 completed or under construction and 16,690 in the pipeline, with the total number of BTR units totalling 22,025.

The ACT has just 2,824 either completed, under construction or planned, while Western Australia has 2,119 and South Australia has 1,269.

While development completions are likely to reach record levels this year, Knight Frank’s Australia Build to Rent Update Q3 2025 found development momentum in the BTR sector was likely to start to taper off in 2026, with around 4,000 units forecast for completion.

Knight Frank Partner, Living Sectors, Valuation & Advisory John-Paul Stichbury said the decline in delivery for BTR stock beyond 2025 reflected feasibility challenges experienced by developers across the residential sector over the last couple of years.

“The good news is that market and macro-economic conditions are now stabilising, providing an improving backdrop for BTR investment activity,” he said.

“Recent signs of easing build cost inflation, reducing interest rates and improving access to capital are renewing confidence across the market.

“Attention has now turned to stimulating the next wave of growth, and as well as an improvement in the macroeconomic environment, supportive Government policy will also be vital for the long-term pipeline.

“A consistent pipeline of new project commencements is needed to ensure that the recent slowdown is only a short-term blip, and central to this is the ability to activate the pool of approved schemes.

“In total there are around 20,500 units in the pipeline sitting at the DA-approved stage where construction has not yet commenced.

“This is a significant number, and these projects will be crucial in sustaining the recent growth trajectory of the sector.”

The Knight Frank report noted that accelerating housing delivery is high up on the government agenda, with BTR representing a key tool to ramp up supply.

The NSW Government recently announced a permanent 50 per cent land tax exemption in a positive move for the sector.

Knight Frank Head of Alternatives Australia Tim Holtsbaum said supportive Government policy would enhance the sector’s appeal to investors and developers in Australia.

“Targeted government intervention can help accelerate project viability and delivery,” he said.

“The MIT legislation passed at the end of last year was a significant step in the right direction and a positive example of the role policy can play in incentivising BTR development and attracting institutional capital.

“However while significant progress has been made on the policy front, there remains work to do.

“The BTR tax environment in Australia is hard to navigate and a more uniform approach across states would be beneficial.

“Tax on foreign investors remains problematic and decreasing this burden for institutional investors from abroad will help to increase Australia’s competitiveness with other countries, where the barriers to entry from a tax perspective are typically lower.

“As global investors scale up their exposure to the living sectors, more entrants are expected to enter the market as the sector is maturing.

“Operational schemes are demonstrating strong performance, with high occupancy rates and steady rental growth, which is providing added confidence to the market and investors,” Mr Holtsbaum added.