2025 Annual Results – Delivers on Guidance and Positioned to Benefit from Improving Key Markets

20 August 2025

Dexus today announced its results for the 12 months ended 30 June 2025, delivering on its FY25 guidance, with AFFO1 of 45.0 cents per security and distributions of 37.0 cents per security.

Ross Du Vernet, Dexus Group Chief Executive Officer & Managing Director said: “In a year marked by ongoing economic uncertainty, Dexus has remained focused on long-term value creation. Our high-quality balance sheet portfolio, led by our market leading office portfolio, together with a large, diversified funds management business, continues to differentiate us.

“Location and quality remain key performance drivers in property markets, reflected in our office portfolio occupancy of 92.3% exceeding the average Australian market occupancy of 85.7%, declining office incentives and record leasing for the stabilised industrial portfolio. Across the portfolio, valuations increased in the second half of the year, marking an inflection point in the valuation cycle and demonstrating the quality of the portfolio. We have made progress on our initiatives that support our medium-term strategic priorities and future growth, while our disciplined capital management approach and selective asset recycling has supported a strong balance sheet as the cycle turns.”

Key highlights

- AFFO of $483.9 million or 45.0 cents per security, in line with guidance. Distributions of $398.0 million or 37.0 cents per security reflected a payout ratio of 82.2%, aligned to the updated distribution policy announced at the FY24 results

- Statutory net profit after tax of $136.1 million, compared to a statutory net loss after tax of $1,583.8 million in FY24, primarily driven by stabilising capitalisation rates driving significantly lower fair valuation losses

- Gearing (look-through)2 of 31.7% remains at the lower end of the 30-40% target range

- Property portfolio continues to demonstrate resilience, maintaining high occupancy3 across the Dexus office portfolio of 92.3% and Dexus industrial portfolio of 96.2%, with rent collections remaining strong at 99.6%

- Dexus Real Estate Partnership 2 (DREP2) raised circa $175 million of third party equity commitments, taking commitments to date to over $480 million4. Dexus also increased its managed stake in Powerco through the acquisition of a further 9% stake on behalf of a client

- Dexus Wholesale Property Fund (DWPF) continued to outperform its benchmark over all time periods. Dexus Wholesale Shopping Centre Fund (DWSF) has continued to deliver performance since transitioning to Dexus’s Platform, outperforming its benchmark over the 1, 3, 5 and 10 year time periods

- Exchanged or settled circa $1.1 billion5 of Dexus divestments, maintaining balance sheet strength and further enhancing portfolio quality

- Secured circa $3.9 billion5 of real asset transactions on behalf of the funds platform, including circa $2.7 billion of divestments

- Customer net promoter score remains strong at +41 across the office, industrial and healthcare sectors reflecting our focus on customer experience

Outlook

Ross Du Vernet said: “We invest for the long term, and despite market challenges over the past few years, we are now past the inflection point with valuations turning positive in the second half. Now is an attractive time to invest in real assets. We expect the next phase of the cycle to be driven by fundamentals, and our platform of high-quality assets and deep expertise positions us well to deliver for our Security holders and clients.”

Financial result

AFFO of $483.9 million was delivered in line with guidance. As expected, this was below the prior year, primarily driven by lower property FFO as a result of divestments, lower capitalised interest and lower trading profits, partially offset by the impact of higher performance fees and cost savings. Rent collections for the Dexus office and industrial portfolio remained strong at 99.6%.

Key drivers of the movement in AFFO included:

- Office and industrial property FFO both decreased, primarily due to the impact of divestments and lower industrial one-off income, partially offset by development completions and contracted rent growth across the portfolio

- Management operations FFO increased due to higher performance fees and net cost savings, partly offset by the impact of redemptions, disposals and lower valuations. The impact of redemptions and disposals is expected to continue into next year. Dexus has secured circa $35 million of performance fees (pre tax) for FY26

- Group corporate costs decreased by $4.7 million driven by active cost management.

- Net finance costs increased by $14.7 million largely as a result of the cessation of capitalised interest at 123 Albert Street and higher interest rates. Higher funding costs are expected to impact in FY26

- Trading profits were lower following reduced trading volume. Circa $40 million of trading profits (post tax) have been secured for FY26

- Maintenance and leasing capex increased due to the continued impact of higher incentives from deals struck in prior periods flowing through the portfolio this year, partially offset by the impact of divestments

Dexus’s statutory net profit after tax was $136.1 million, compared to a statutory net loss after tax of $1,583.8 million in FY24. This movement was primarily driven by significantly lower fair valuation losses on investment property as a result of stabilising capitalisation rates across the portfolio compared to FY24.

Property portfolio valuations turned positive in the second half, with the office portfolio valuations increasing by 0.4% on prior book values and the industrial portfolio increasing by 1.0%. Overall, for the 12 months to 30 June 2025, the portfolio valuations resulted in a total circa 1.1% decrease on prior book values. These revaluation losses primarily drove the 16 cent or 1.8% decrease in net tangible asset (NTA) backing per security during the year to $8.81 at 30 June 2025.

Dexus maintained a strong balance sheet with gearing (look-through)2 of 31.7%, at the lower end of the 30-40% target range, and $3.0 billion of cash and undrawn debt facilities. Dexus has a weighted average debt maturity of 4.3 years, manageable near-term debt expiries and remains within all of its debt covenant limits, retaining its credit ratings of A-/A3 from S&P and Moody’s, respectively. On average, 86% of Dexus’s debt was hedged throughout FY25 at a weighted average rate of 2.1%, providing material interest rate protection.

Sustainability

Dexus’s commitment to delivering strong sustainability outcomes underpins long-term performance. During the year, Dexus progressed the priority areas of its sustainability strategy:

- Climate action: Continued to maintain net zero emissions across Scope 1, 2 and some Scope 3 emissions6 and source 100% renewable energy for the managed portfolio. Dexus also released its updated Climate Transition Action Plan.

- Customer prosperity: Improved the NABERS Indoor Environment average rating across the Platform’s office portfolio to 5.6 stars (FY24: 5.2 stars). Dexus completed the first battery storage installations at industrial assets including ASCEND at Jandakot Airport and Horizon 3023, Ravenhall.

- Enhancing communities: Established national partnerships with Black Dog Institute and headspace, with campaigns focused on local connections for healthy hearts and minds. Dexus also continued to expand its local activations and volunteering with community partners across the managed portfolio.

Dexus continued its strong sustainability performance, ranking third among REIT peers and in the top 5% globally in the S&P Global ESG Index. Dexus Office Trust, Dexus Office Partnership and Dexus Wholesale Shopping Centre Fund ranked in the top 10% of participants globally in the GRESB 2024 Real Estate and Infrastructure Assessments. Multiple funds gained recognition and all participating infrastructure assets maintained or improved their GRESB star ratings.

High quality property portfolio remains resilient

Dexus’s $14.5 billion high quality portfolio predominantly comprises $9.7 billion in office and $3.6 billion in industrial.

Office portfolio

In office, stabilising capitalisation rates, rent growth, positive net absorption across all four major CBDs, and a supportive supply pipeline all point to the Australian office sector being in the early stages of a pronounced recovery. Dexus’s high quality, strategically located office portfolio underpins over 60% of earnings and remains well positioned to benefit from the turning market.

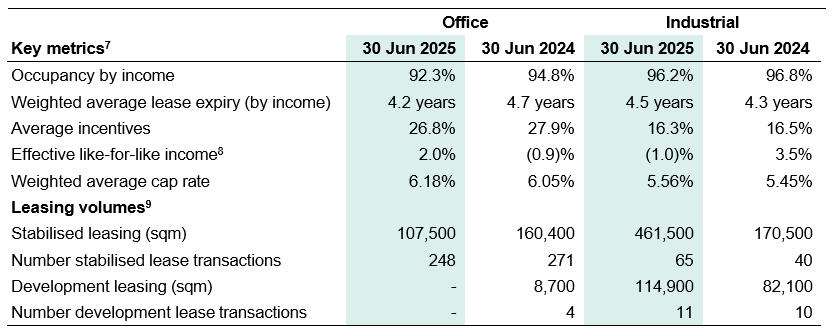

Dexus’s portfolio occupancy3 remains well above market average at 92.3%, albeit reducing since FY24 predominantly due to expiries at 80 Collins Street in Melbourne and 30 Hickson Road in Sydney. Leasing volumes of 107,500 square metres for the year were weighted towards smaller deals in the Sydney CBD. Dexus’s average incentives reduced to 26.8%. Effective like-for-like income growth8 improved to 2.0%, with fixed rent increases partially offset by amortisation impacts and downtime on vacancies. On a face basis, excluding amortisation, like-for-like growth was 2.3%.

A positive shift in tenant confidence continues, particularly for high quality product, with the vast majority of tenant renewals retaining the same space (FY25 90%, FY24 50%) and only a minimal share contracting (FY25 5%, FY24 36%), reflecting a strong improvement from FY24.

Industrial portfolio

Leasing momentum was strong across Dexus’s industrial portfolio during the year, with record stabilised leasing volumes more than double that achieved in FY24. There was a slight reduction in portfolio occupancy by income due to expiries at select assets which was largely offset by leasing, while occupancy by area increased slightly to 97.4%, above the national average.

Effective like-for-like income8 declined by 1.0%, impacted by downtime on select vacancies. Dexus improved occupancy at key assets and achieved 25% releasing spreads during the year, with FY26 like-for-like income expected to recover strongly.

The portfolio remains materially under-rented at 11.7%, creating the opportunity to grow income by resetting the rents on vacancy and upcoming lease expiries across approximately one-quarter of the portfolio by FY27.

Developments

The Platform’s real estate development pipeline now stands at a cost of $13.3 billion10, of which $7.1 billion10 sits within the Dexus portfolio and $6.2 billion10 within third party funds.

Dexus has circa $700 million of committed spend on its pipeline in FY26. Atlassian Central and Waterfront Brisbane will become next generation assets and enhance portfolio quality for Dexus and its capital partners. Dexus’s city-shaping office developments have been materially de-risked via fixed price contracts and 71% of weighted average leasing pre-commitments. Atlassian Central is on schedule to complete in late 2026, and Waterfront Brisbane is now expected to complete in late 2028 following prolonged adverse weather in Brisbane together with complexities with certain in-ground construction works, which are nearing completion.

Dexus progressed 190,400 square metres of industrial construction across 10 projects, six of which are fully leased11. At the flagship industrial development precincts of Horizon 3023, Ravenhall and ASCEND Industrial Estate, Jandakot Airport, Dexus completed construction across 54,900 square metres and is 100% leased, with a further 18,100 square metres completed at Moorebank in NSW which is 62% leased11.

Funds management platform continues to deliver for investors

Dexus manages $35.6 billion of funds across its diversified funds management business.

The funds platform continues to deliver performance for investors. Flagship fund Dexus Wholesale Property Fund (DWPF) outperformed its benchmark across all time periods, including by circa 435 basis points for the 12 months to 30 June 2025. Dexus Wholesale Shopping Centre Fund (DWSF) continued to deliver performance since transitioning to Dexus’s Platform, outperforming its benchmark over the 1, 3, 5 and 10 year periods.

Following the sale of DWSF’s 50% interest in Macquarie Centre, Dexus worked with the fund, leveraging its long-standing relationship with Scentre Group to secure an attractive replacement asset for investors.

Westfield Chermside is Australia’s second largest regional shopping centre and delivers immediate performance and strong growth potential.

Despite the subdued capital raising market, Dexus continued to harness pockets of investor demand. DREP2 has raised over $480 million4 in total equity commitments, with further commitments expected in FY26. Funds from DREP1 and DREP 2 were also deployed into investments, including the acquisition of an office conversion to student accommodation opportunity. Dexus increased its managed stake in Powerco to 51% through the acquisition of a further 9% stake on behalf of a client.

Dexus divested $2.7 billion on behalf of several funds, helping to maintain prudent gearing levels, improve portfolio quality and facilitate $1.8 billion in investor redemptions. Dexus also facilitated more than $450 million of secondary unit transactions, materially reduced costs and closed two sub-scale funds.

In May 2025, Dexus received a Notice from Australia Pacific Airports Corporation (APAC), the owners of Melbourne and Launceston Airports, alleging it had breached the APAC shareholders’ Deed when undertaking a sale process on behalf of some of its clients in the Dexus-managed APAC Bloc. Dexus is vigorously defending its clients’ interests, has disputed the validity of the Notice and has obtained an injunction against APAC that will remain in place until a final ruling is received, with the court hearing scheduled for November 2025.

Dexus remains focused on delivering performance for its fund clients, and while some fund specific matters are worked through, there are clear plans in place to resolve these. Dexus’s large funds management business provides exposure to diversified real asset investments with opportunity for growth as the market stabilises and redemptions are resolved.

Transactions and trading

Despite a challenging transactions market, Dexus undertook circa $5.0 billion5 of transactions across the Platform, comprising $1.2 billion of acquisitions and $3.8 billion of divestments, including circa $1.1 billion of exchanged or settled Dexus divestments since 30 June 2024. This includes the divestment of 3 Brookhollow Avenue, Baulkham Hills and 149 Orchard Road, Chester Hill which contribute to the circa $40 million of trading profits (post tax) secured for FY26.

FY26 Guidance

Barring unforeseen circumstances, for the 12 months ending 30 June 2026, Dexus expects AFFO of 44.5 – 45.5 cents per security and distributions of 37.0 cents per security12.

FY25 Results

This ASX announcement should be read in conjunction with the 2025 Annual Results Presentation, 2025 Annual Report, Appendix 4E, 2025 Financial Statements, 2025 Management Approach and Procedures, 2025 Sustainability Data Pack and 2025 Property Synopsis, and Appendix 4G and Corporate Governance Statement released to the Australian Securities Exchange today and available on www.dexus.com/dxs.

Investor conference call

Dexus will hold an investor conference call at 9.15am (AEST) today, Wednesday 20 August 2025, which will be webcast via the Dexus website (www.dexus.com/investor-centre) and available for download later today.

- AFFO in accordance with guidelines provided by the Property Council of Australia (PCA) comprises net profit/loss after tax attributable to stapled security holders calculated in accordance with Australian Accounting Standards and adjusted for: property revaluations, impairments and reversal of impairments, derivative and foreign exchange mark-to-market impacts, fair value movements on financial assets held at fair value, fair value movements of interest bearing liabilities, amortisation of tenant incentives, gain/loss on sale of certain assets, straight line rent adjustments, non-FFO tax expenses, certain transaction costs, one-off significant items, amortisation of intangible assets, movements in right of use assets and lease liabilities, rental guarantees and coupon income, less maintenance capital expenditure and lease incentives.

- Adjusted for cash and debt in equity accounted investments and excluding Dexus’s share of co-investments in pooled funds. Look- through gearing including Dexus’s share of equity accounted co-investments in pooled funds was 33.3% at 30 June 2025.

- By income.

- Includes recent applications received (but not yet accepted).

- Includes all transactions which exchanged or settled post 30 June 2024 (including transactions that have been secured post 30 June 2025).

- Covers Scope 1,2 and some Scope 3 which received limited assurance. In line with Climate Active Carbon Neutral Standard for Organisations, net emissions for the year ended 30 June 2025 include offsets purchased, retired (majority) and allocated for retirement during the year and up to the date of this report. Final Climate Active certification expected to be achieved post-reporting period. Refer to Sustainability Data Pack available at dexus.com/dxs for Scope 3 inclusions.

- Dexus balance sheet portfolio performance statistics exclude co-investments in pooled funds and excludes development leasing.

- Includes provision for expected credit losses.

- Includes Heads of Agreements.

- Includes Central Place Sydney scheme which is under review.

- Including Heads of Agreement post 30 June 2025.

- Based on current expectations relating to asset sales, performance fees and trading profits, APAC litigation assumptions, and subject to no material deterioration in conditions.