2023: Investment Rebound Forecast with Pressure Easing on Yields, Says Savills Report

7 December 2022

According to leading agency Savills Australia’s 2023 Spotlight research report, commercial property investment is tipped to bounce back in 2023 as the interest rate outlook becomes clearer, potentially limiting further outward yield movement.

Datacentre demand is set to intensify in 2023, spurred by an increase in the appetite and need for secure data storage and connectivity. From a cybersecurity standpoint and increasing focus on governance, risk, and business continuity, more firms will employ processes to mitigate risks, and this will drive up office utilisation rates in some cities as well as increase demand for colocation or micro data centres.

The 2023 Spotlight forecasts that Industrial and Hotel asset classes will remain the prized sectors and will be hotly contested, with Pub sales to remain buoyant. Student Accommodation is also set to surge as international students return to Australian shores and Savills forecasts further growth in our emerging Built to Rent (BTR) sector.

According to Savills, the office sector is expected to pick-up in 2023, with the rise in enquiry to fuel pent-up demand on recovery. Savvy landlords will continue to recognise the growing importance of ESG and continue to enhance environmental credentials and performance of commercial office assets.

Capital Markets Impacts: Australia Preferred APAC Investment Location

According to Savills, transactional activity has been limited at the close of 2022 with greater uncertainty around the economic outlook causing a widening in the Bid-Ask spread between purchaser and vendor.

“Some investors will continue to wait for the impact of higher interest rates to wash through valuations, but low leverage among major investors means higher interest rates pose limited systemic risks to the commercial property sector,” said Katy Dean, National Head of Research, Savills Australia.

The Savills report reveals REIT balance sheets are strong, with leverage at an all-time low. The average LVR is around 35%, significantly lower than the GFC peak of around 60-65%, creating a buffer against the impact of rising interest rates.

Falling bond yields in 2023 will ease the pressure on property yields with the potential to limit further widening. However, Savills cautions that movements in yields could diverge significantly by individual asset depending on sector, quality, location, and lease length. Declining market interest rates could also help to facilitate a rebound in investment through reduced funding costs, and lower future returns on alternative fixed income investments.

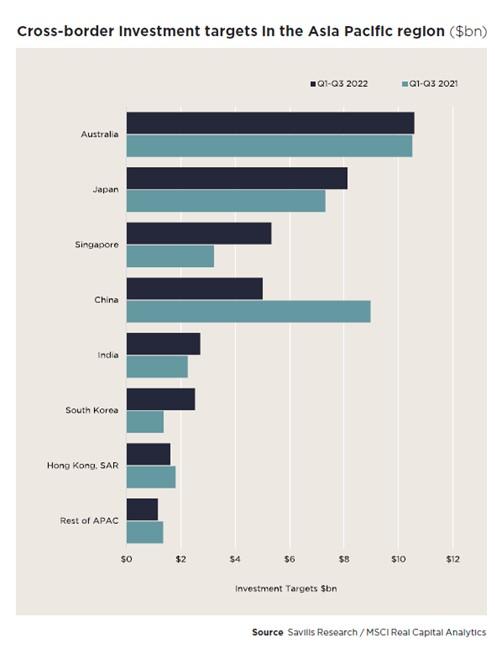

“Australia is often seen as a safe haven for offshore investors and will retain its appeal with a robust economic growth outlook and high yields compared to many major markets, coupled with the weaker Australian dollar giving us a firm value advantage,” said Ms Dean.

According to Savills 2023 Spotlight Report, US and Singaporean investors have played a key role in cross-border investment, accounting for 60% of offshore investment volume in the September 2022 quarter and 54% over the year to September 2022. Activity has been fuelled by the low value of the Australian dollar and Savills forecasts US and Singaporean investors will remain active in 2023.

2023 – Savills’ Trends to Watch

Data Centre demand to intensify. Competing demand from data centres for sites in some markets could begin to price out traditional users. Savills predicts the increase in cyber-crime coupled with growing appetite for data storage, cloud computing and connectivity, will further drive demand in 2023 resulting in a greater reliance on data centres, including traditional offsite servers and micro-data centres.

Student Accommodation back on the investor wish list. Investor interest in student accommodation is set to rise in 2023, driven by the recovery of international student enrolments, strong occupancy, and outperformance in rental growth during 2022. As international student numbers continue to rebound and supply remains constrained, Savills forecasts strong demand for investment into purpose-built student accommodation.

Build-to-Rent sector to grown in 2023. Australia’s BTR sector will continue to grow, with the yield stability of the sector reinforcing its long-term income stream capabilities. Residential rents have quickly recovered post COVID-19 lockdowns and declining availability of rental product will fuel future demand. With projections for the formation of smaller households to continue combined with increasing immigration, Savills says 2023 is set to see the trend for record low vacancy rates to remain.

Pent-up demand will boost pub sales in 2023. Pubs have experienced record investment sales activity since the initial COVID-19 lockdown period in 2020. Renewed investor demand will see pub assets remaining sought after in 2023 – particularly renovated pubs with sustainable and consistent earnings. However, Savills flags that increased legislative pressure on gaming could cause a recalibration of expected yields and sale prices.

Hotel investment activity to remain buoyant. The recovery in hotel trading fundamentals has been strong, especially in Brisbane and Adelaide, easing any potential debt serviceability issues. Record ADR levels are being achieved, with operators using the pandemic period as an opportunity to reset rates.

Room rates may level out or drop in 2023 but Savills expects occupancy to continue to trend upwards in compensation. Long-term rentals are less volatile and with state governments introducing new limits on the number of days in which hosts can rent out their properties, along with registration requirements, there is upside for the hotel economy, as well as the residential sector.

Industrial and logistics – rents tipped to rise. Competitive tension will remain for industrial stock with vacancy to remain low. This will continue to push industrial rents in both prime and secondary markets in the short term. However, industrial land prices are increasing, and with materials and labour in short supply combined with escalating building costs – the development cycle will be extended. Vacancy averages less than 1.0% in many markets and this is keeping intense pressure on new development take-up rates, suggesting substantial rental growth will continue in 2023.

Supply chain disruption to ease. While the effect of e-commerce growth is still playing out, there has been evidence of some improvements in the supply chain, including declining shipping costs, greater container availability and easing of port congestion. Price drops of some commodities suggest that shortages are easing, while an increase in industrial production suggests manufacturers are better positioned to meet demand levels.

Warehouse industrial demand may slow as inventories are managed down but record low vacancy will remain with available stock in short supply.

Intensified demand for ‘green’, driven by growing ESG commitments and competition for talent. ESG will also be an important focus for asset managers, particularly the use of big data and analytics to realise the green premium.

Occupiers demanding green credentials. ESG initiatives will become a more critical part of investment strategies across all asset classes, with landlords adopting green building certifications, energy efficiency upgrades, and green investment. The green agenda remains a growing priority for corporate occupiers seeking to meet their own net zero commitments.

Greater demand for long-term secure income stream assets. Global Assets Under Management (AUM) are over USD$123 trillion (Deloitte 2021) almost double the 2016 volume, reflecting the increasing allocation to property from institutional, private equity, and sovereign wealth funds. Savills forecasts this could lead to greater demand in 2023 for long-term secure income stream assets such as industrial/logistics, BTR and core office.

Multi-speed office leasing market. Occupier requirements for Prime Grade office, and low supply in core locations will sustain current demand but there may be a softening of incentives in peripheral locations to attract and retain tenants. Savills expects to see increased flight to quality across asset type (core), higher building quality (Premium, high quality A grade, highly green-rated) as well as flight to location with well-located, notably CBD or gateway locations front of mind for occupiers in 2023.

Investors more selective – flight to quality will continue. The market may see a greater divergence between asset classes, with increased demand for top locations, top quality assets in office, industrial and retail.