The Australian Federal Government has announced almost $A40 billion of new spending across the five years from 2021-22 to support economic growth for Australia. This is however akin to releasing the flood gates when the river is already full, and clearly framed in re-election politics.

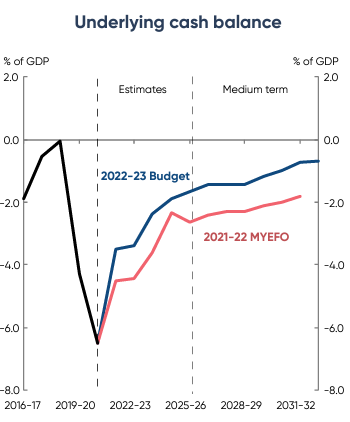

With the unemployment rate expected to fall below 4 per cent this year, the first time in nearly half a century, the government will rake in nearly $103bn more tax over the next 5 years than previously thought, enabling the Government to spend a little (like a lot) and save a little. The Budget estimates a halving in the deficit to 1.6 per cent of GDP by 2025‑26 before falling to 0.7 per cent of GDP by the end of the medium term, well ahead of the previous MYEFO estimate.

Economists do however expect that the spending will be inflationary, adding to pressures in wages, inflation and interest rates.

Alan Oyster, Chief Economist at NAB thinks the Government could have done more saying “Overall, we have no problem with the focus on maintaining the support for economic growth but we see the scope for more structural/productivity enhancing measures to have been included. Further measures that cut red tape, reform taxation and provide greater support for renewable energy would have been welcomed. This budget also does not change expectations for monetary policy – i.e., the RBA will move soon to moderately increase rates (we expect that process to start by August this year).”

ANZ Chieft Economist said, Richard Yetsenga said, “Fiscal policy is working hard to ensure the economy is going to stay strong, and once the Reserve Bank of Australia (RBA) starts to tighten, it will need to move quite some way to ensure inflation remains consistent within its target band.”

ANZ Research expects the RBA cash rate to reach 2.0 per cent by the end of 2022. The RBA will also, of course, want to ensure it doesn’t overtighten. This is going to be a fine balancing act.

“Spending is 27.8 per cent of gross domestic product (GDP) – second only to last year’s 31.6 per cent of GDP record. The economic forecasts are on the conservative side, suggesting additional spending could even be forthcoming after the election.” said Mr Yetsenga.

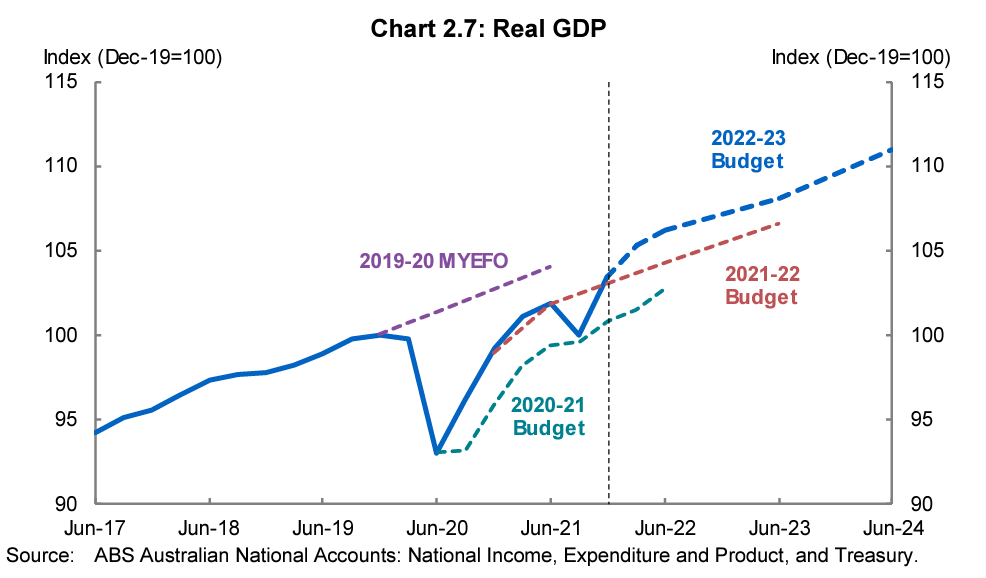

The outlook for real GDP has strengthened in the near term, with growth forecast to be 4¼ per cent in 2021-22 and 3½ per cent in 2022-23, before moderating to 2½ per cent in 2023-24.

With the election looming and an Opposition suggesting a revised budget if elected, there is some doubt that all of the spending measures will actually be implemented. The Government also has a Contingency Reserve of $15.4 billion by 2025-26 from which the Government may dip into to fund further announcements in the lead up to the election.

Property Council Chief Executive Ken Morrison said “Australia’s economic recovery has been remarkable and the budget confirms strong conditions are likely in the year ahead,” Mr Morrison said.

“However, it is clear that the budget results are contingent on a strong bounce back in population growth and there are risks that falling housing supply also becomes a looming drag on the economy.”

“Net overseas migration is predicted to grow strongly next year, but this does not return to pre-pandemic levels for more than two years.”

“If these migration targets are not achieved this will be a drag on the economy and the budget, and we urge the government to pull all stops to achieve a fast return to normal population levels as soon as possible,” Mr Morrison said.

The budget also highlighted the extent of the housing supply crisis in Australia, predicting dwelling investment levels would drop significantly, from 5 per cent growth this year, into negative territory (-0.5 per cent) by 2023/24.

“While the HomeBuilder scheme saved jobs and delivered great benefits to households, the record pipeline of work it created will come to an end just as our population begins to recover, which will intensify the supply crunch we know is coming,” Mr Morrison said.

“Both HomeBuilder, and the expanded Home Guarantee Scheme are welcome demand-side measures, and cannot address the supply-side issues which increase the cost of new homes.

“The Government’s own forecasts from the National Housing Finance and Investment Corporation (NHFIC) predict that housing supply is set to drop by 35 per cent right at the time population growth would resume, leading to a national deficit of 163,400 homes by 2032.

“New Property Council research released last week also showed 70 per cent of Australians now believe the great Australian dream of home ownership is out of reach for most people, and that 90 per cent of aspiring homeowners say it’ll be one of the most important issues in deciding their vote at the federal election.

“Additionally, it was very pleasing to see in this budget that NHFIC will secure an additional $2 billion to help boost investment in affordable housing,” he said.

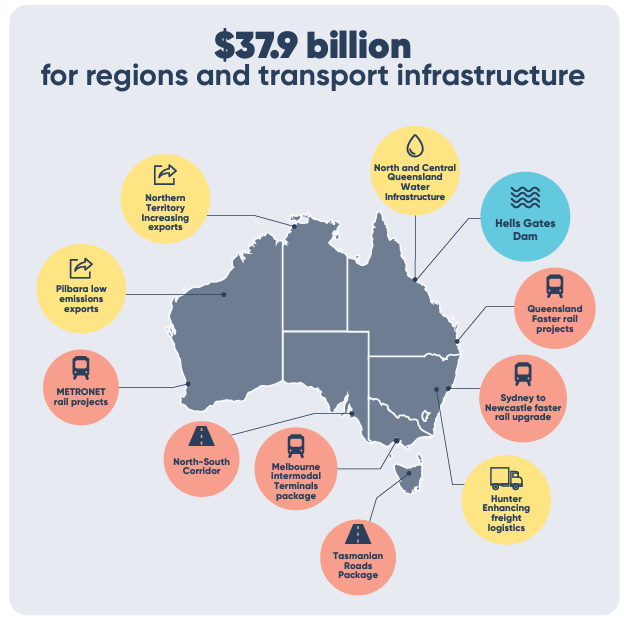

Major Projects

- $7.4 billion for new and expanded dam projects including $6.6 billion for development of a new food bowl in Australia’s north

- $2.3 billion for the North-South Corridor – Darlington to Anzac Highway SA

- $1.6 billion for the Brisbane to the Sunshine Coast – Beerwah-Maroochydore Rail Extension

- $1.5 billion for the Beveridge Interstate Freight Terminals and connecting roads

- $1.1 billion for the Brisbane to the Gold Coast – Kuraby-Beenleigh Faster Rail Upgrade

- $1.0 billion for the Sydney to Newcastle – Tuggerah to Wyong Faster Rail Upgrade

- $920.0 million for the Melbourne Outer Metropolitan Ring Rail South

- $811.8 million Connecting Regional Australia initiative to expand mobile coverage, improve accessibility, and resilience to natural disasters

- $500m for local road and community infrastructure projects in the states and territories

- $441.2 million for the METRONET in Western Australia

- $400.0 million for the Outback Way – Western Australia

- $392.0 million for the Tasmanian Roads Package

- $352.0 million for the Milton Ulladulla Bypass

- $200.0 million for the Marion Road – Anzac Highway to Cross Road project

- $132.0 million for the Central Australian Tourism Roads

- $124.0 million for the Outback Way – Northern Territory

- $100.0 million for TAS Great Drive Tourism Support – Packages

- $46.7 million for the Athllon Drive Duplication – ACT

- $2.8 million for the Kent Street and Novar Street Intersection Upgrades