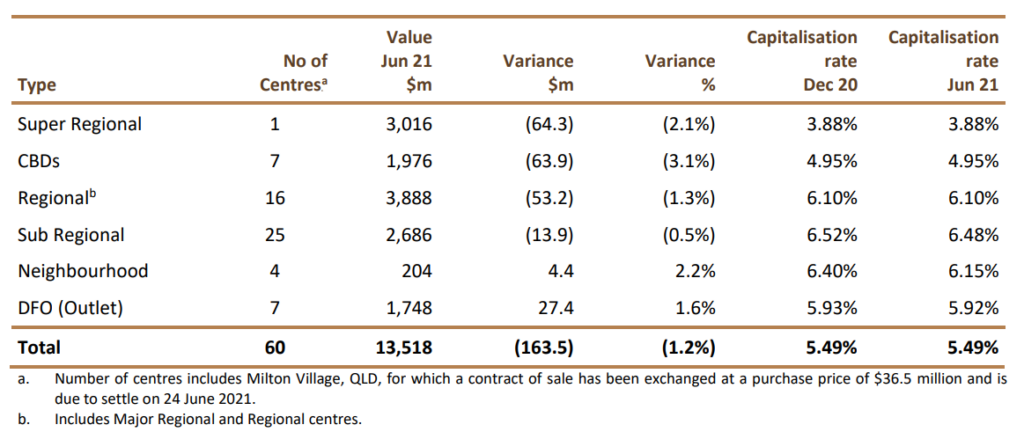

Vicinity Centres confirmed their year end Dividend of 6.6cents and confirmed the results of their latest valuations showing a decline in their holdings of $164m or -1.2%.

Neighbourhood Centres and the DFO portfolio have been Vicinity’s saviours with the larger Centres suffering declines in rental income and valuation. Despite the overall portfolio cap rate remaining stable at 5.49%, Vicinity’s values have dropped due to lower net incomes in the CBD, Super Regional and Regional Centers with Vicinity laying the blame on the Victorian Government proposed land tax and stamp duty increases, which take effect during FY22 and from a softening in market rents.

Vicinity advised that it had undertaken independent valuations for 39 of its 60 directly owned retail properties.

The Neighbourhood Centres showed a positive valuation movement predominantly due to a tightening of cap rates from 6.4% to 6.15%. Net Incomes from the 4 Neighbourhood Centres were down slightly.

The DFO Centres showed a positive net income variance and a 1bps compression in cap rates to show a 1.6% increase in overall valuations.

The results were summarised by Vicinity as follows;

Vicinities half year distribution result brings the full year distribution to a total of 10cents per security and equates to a distribution yield of 6% on the current price of $1.655. Vicinity advised that the distribution has been impacted a number of items including;

- A decrease in FY20 rental waivers and provisions which has benefited FY21 Net Property Income;

- Elevated surrender payments;

- Temporarily reduced interest costs in 1HFY21 from the interest rate swap restructure; and

- Short term cost savings as a result of the COVID-19 pandemic.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.