A prime 21ha parcel of prime industrial land in Sydney’s Huntingwood district has been sold for a staggering $201m.

The property was sold by China’s Lesso Mall Developments who had acquired the property in 2016 from the NSW Government. Lesso Mall intended to establish a distribution facility on the site to support a chain of Lesso Mall Centres offering the direct sale of hardware, electrical equipment and building material products imported from China. The “Bunnings buster” group opened a store in Greenacre and also acquired a site at 79-99 St Hilliers Rd, Auburn for $65 million from Dexus, but the chain failed to take off.

Lesso Mall Developments negotiated a deal with Airtrunk for the right to develop a DataCentre on the site. Airtrunk lodged plans for SYD3, a $472m data centre over four levels containing 16 data halls, a rooftop plant and equipment, two electrical substations, diesel generators, ancillary offices and 101 car parks. The project was however not able to overcome the objections of Blacktown City Council and Airtrunk withdrew the DA in August 2021 and elected to proceed with an alternative site at 51 Huntingwood Drive.

Lesso Mall immediately put the property to the open market in August, appointing Colliers’ Gavin Bishop, Sean Thomson and David-Hall, alongside CBRE’s Jason Edge, Cameron Grier and Chris O’Brien.

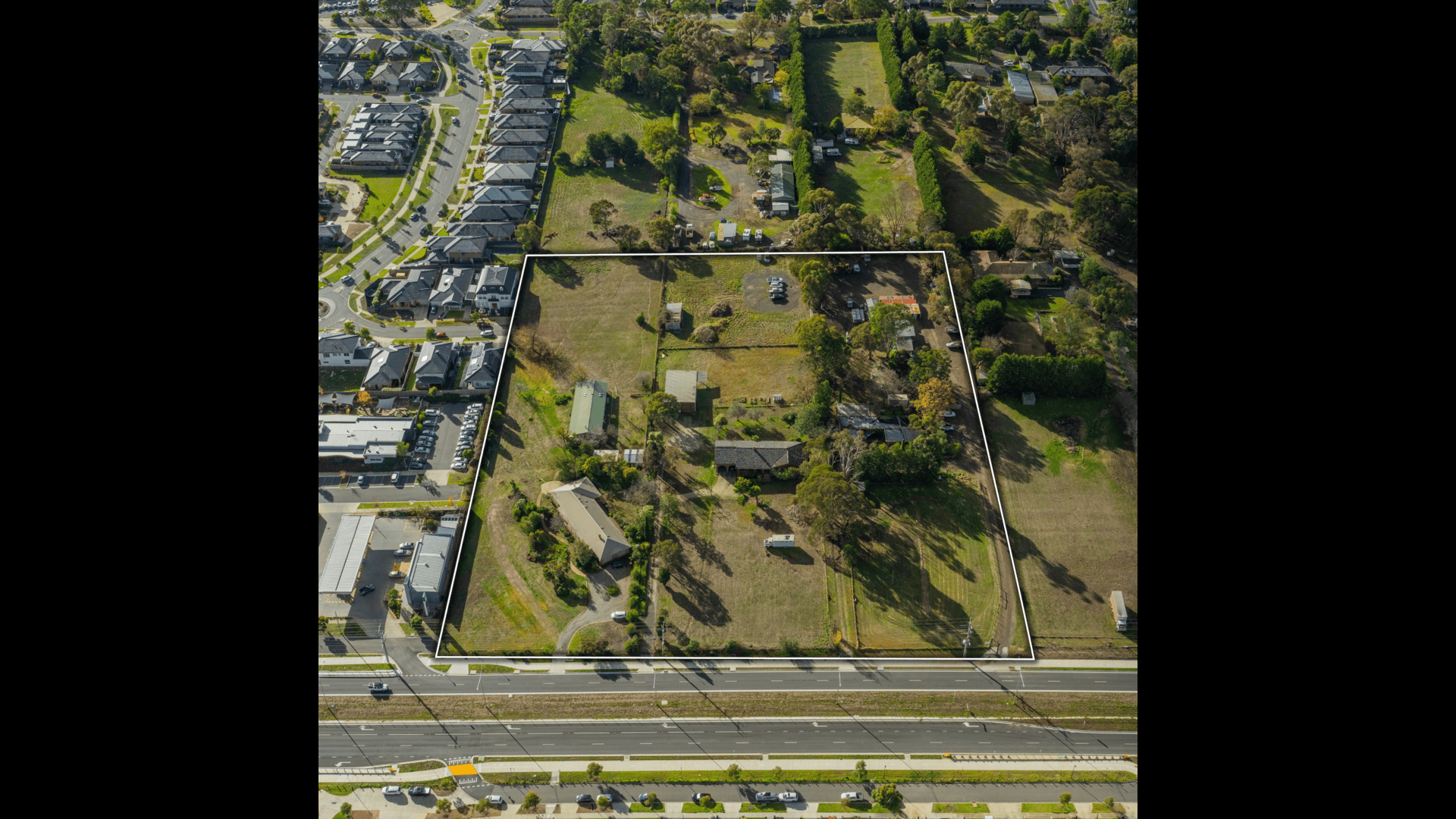

The site is zoned General Industrial and benefits from a multitude of flexible development options given its prominent exposure of more than 900 metres to the M4 Motorway and Great Western Highway, with further frontages to Augusta Street and Berith Street.

The purchaser, represented by The Trust Company is remaining tight lipped about their acquisition.

Update

An announcement on the 9th February confirmed that LOGOs were the purchaser of the site.

LOGOS’ Head of Australia and New Zealand, Darren Searle, said: “The Huntingwood site is one of the largest remaining industrial zoned land holdings in central-west Sydney capable of delivering a large-scale prime-grade logistic estate. With strong connectivity to key transport infrastructure, The Estate will be able to support the increasing demand from e-commerce, transport and logistics customers looking to service Western Sydney’s growing residential population”.

The acquisitions follow the venture’s initial seed asset in April 2021, being an 18.2ha prime development site in Wacol, Brisbane, currently under construction with a significant tenant pre-commitment and was acquired along with a property a 7.8ha site at Radford Road, Reservoir, VIC.

The transactions reflect the venture’s investment strategy to acquire and develop modern, high-quality logistics facilities across Australia’s core markets, and increases the portfolio end value to ~A$900 million.

Demand for industrial land in Sydney continues unabated as institutional groups including Charter Hall and Altis adopt a build-to-core strategy. Continued yield compression and limited buying opportunities for contemporary logistics space have made it more challenging to acquire stabilised assets, and as a result, major institutions seek scale via greenfield development.

CBRE’s Jason Edge said “With a strong focus from domestic and offshore capital to invest in logistics, the interest in this sales campaign was significant. Buyers were attracted to the scale and infill nature of the offering. The ability to attract occupiers that rely on a strong road network as well as being within close proximity to their end customer.”

Cameron Gier added, “with vacancy rates effectively now at 0% in Western Sydney and expected to remain low for the next 36 months due to strong and sustained occupier demand, we are seeing genuine rental growth which supports the high price achieved for this site”