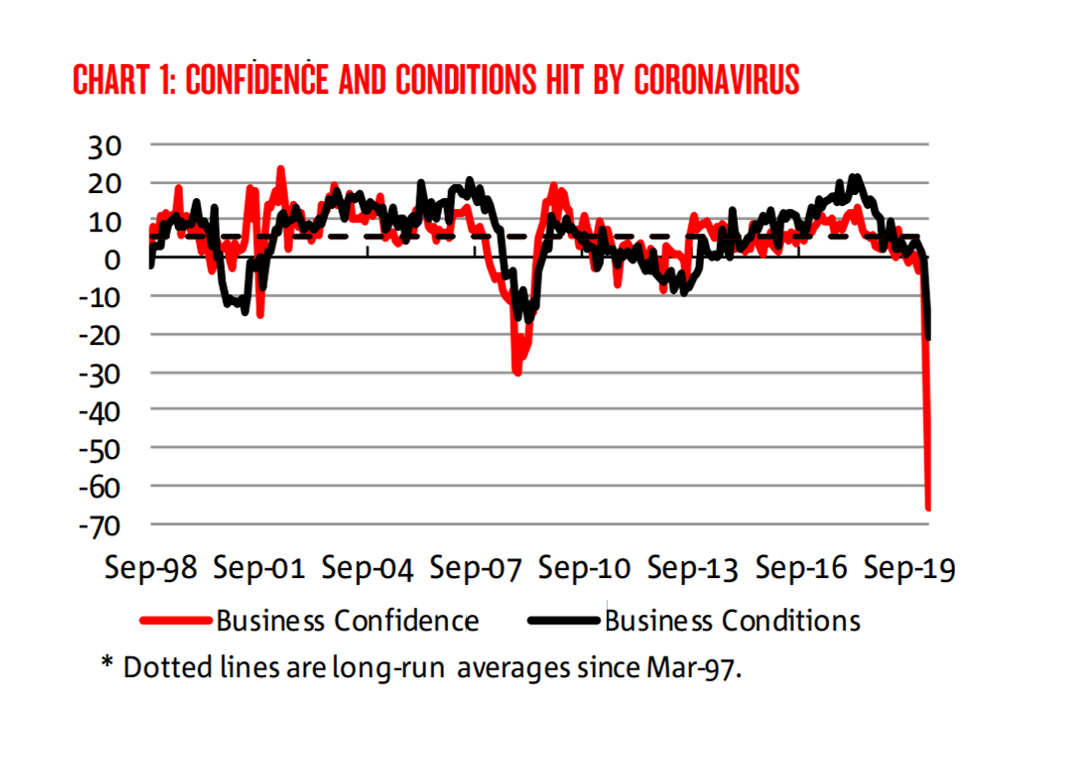

The COVID-19 led economic slow down had a major impact on commercial market sentiment in Q2, with NAB’s Commercial Property Index falling to an unprecedented -62 points (surpassing the previous low of -19 in Q3 2012).

Sentiment collapsed in Retail (-76), Office (-68) and CBD Hotels (-60), but the fallout for Industrial property (-28) was comparatively limited.

Sentiment fell steeply in all states, with VIC (-60), NSW (-63) and QLD (-49), joining SA/NT (-67) and WA (-63) in deeply negative territory.

The hit to confidence was also severe, with the 12-month index falling to -55 and the 2-year measure to -29 – its first ever negative read. The results suggest property experts are not expecting markets to improve any time soon.

With COVID-19 driving new norms around how we work, shop and live, confidence levels are now weakest for Retail and Office property. Confidence has also been shaken (and is now negative) in all states.

Expectations for capital growth for the next 1-2 years were pared back significantly for Office (-4.4% & -3.0%) and Retail (-4.7% & -2.8%), with falls predicted in all states. Industrial values are set to fall moderately in the next 12 months, but the outlook in 2 years’ time is positive.

Office vacancy hit a 2-year high 8.5% in Q2, and climbed steeply in VIC (7.4%) and NSW (6.7%). Retail vacancy also hit new survey highs (9.0%), but industrial property remained insulated, with vacancy falling (5.8%).

As many commercial tenants struggle in the wake of the COVID-19 led downturn, the outlook for rents was pared back sharply for both Retail (-5.6% & -3.6%) and Office (-4.5% & -2.9%) property over the next 1-2 years.

Supply over-hangs have now also emerged in all sectors, bar Industrial.

The number of developers looking to start new works in the next 18 months fell heavily to a survey low 68% in Q2, suggesting the disruption caused by the pandemic has not only had an immediate impact on the building construction industry, but will continue to impact over the next few years.

Property experts indicated that debt funding conditions were more difficult in Q2, and expect it will remain so in the next 3-6 months. With market uncertainty persisting, the average pre-commitment required to meet funding requirements for new developments across Australia rose significantly for both residential and commercial property in Q2.

New research finds that 8 in 10 property experts expect the biggest changes in Office markets from COVID-19 will be the continuation or extension of working from home, and structural changes as to how office space is used.

A large number also expect to see slower leasing volumes and renewals, and cashflow reductions due to firms’ ability to continue operating and pay rent and how this will impact investors’ mindset as key changes. Only 2% believe that conditions will return to pre-Covid-19 patterns.

New research also shows COVID-19 had a big impact on rent collections across all Retail property formats. Bulky Goods Retail and Large Format Retail look to have held up best, with 30% and 21% of property experts reporting no change in collections from these formats. This compares to 7- 8% from Neighbourhood and Regional Shopping Centres and in Strip Retail.

At the other extreme, rent collections were 30-50% lower from significantly more Strip Retailers (43%), and were down 50% or more from 45% of Other Retailers, 24% of Strip Retailers and 20% of Regional Shopping Centres.