Neighbourhood shopping centres continue to attract attention with the sale Market Plaza Chipping Norton in New South Wales for $37.4m.

JLL’s Nick Willis, Sam Hatcher and Dylan McEvoy have exchanged contracts following the formal on market expressions of interest campaign. The centre, anchored by a strong performing Coles supermarket, has transacted at a yield of 4.75% to a private investor.

JLL’s Retail Investments (Australia) Senior Director, Nick Willis said, “The convenience and Large Format Retail sectors continue to attract the strongest investor interest and highest conviction given the sectors outperformance over the past 24 months. The investor interest is broad; ranging from private high-net worth investors, global pension and sovereign funds and the A-REIT’s all looking to increase scale in what is a highly fragmented market.

The campaign attracted strong investor interest nationally and internationally, resulting in 11 formal EOI’s being received.

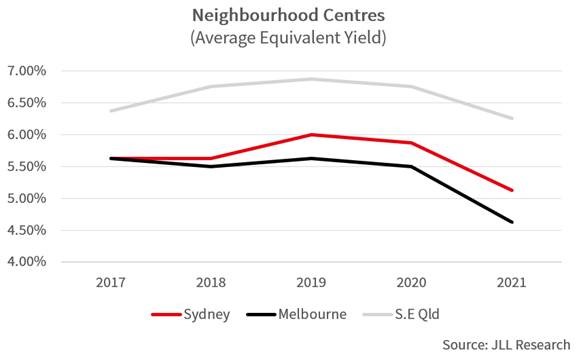

“Supply of investment product remains a key issue for this part of the retail market, with demand drastically outweighing available supply. This imbalance will continue to drive yield compression and potential for further M&A and strategic partnerships in 2022,” said Mr Willis.

JLL Research shows that $2.7 billion worth of neighbourhood shopping centres transacted in 2021, trading at a 81% uplift compared to the year prior, and up 45% and 64% on the 5 and 10 year averages, respectively.

JLL’s Retail Research (Australia) Senior Director, Andrew Quillfeldt said, “The recent spike in COVID-19 case numbers is likely to re-introduce many of the trends evident over the last two years during periods of restricted movement, resulting in an increase in spending on grocery and Large Format Retail (LFR). The strength in underlying sales performance in these two main categories will continue to support investor confidence and demand for neighbourhood and LFR shopping centres.

“Although there is some economic uncertainty in 2022, consumer confidence remains positive and the household sector is in a good position to be supportive of retail spending across all categories,” said Mr Quillfeldt.