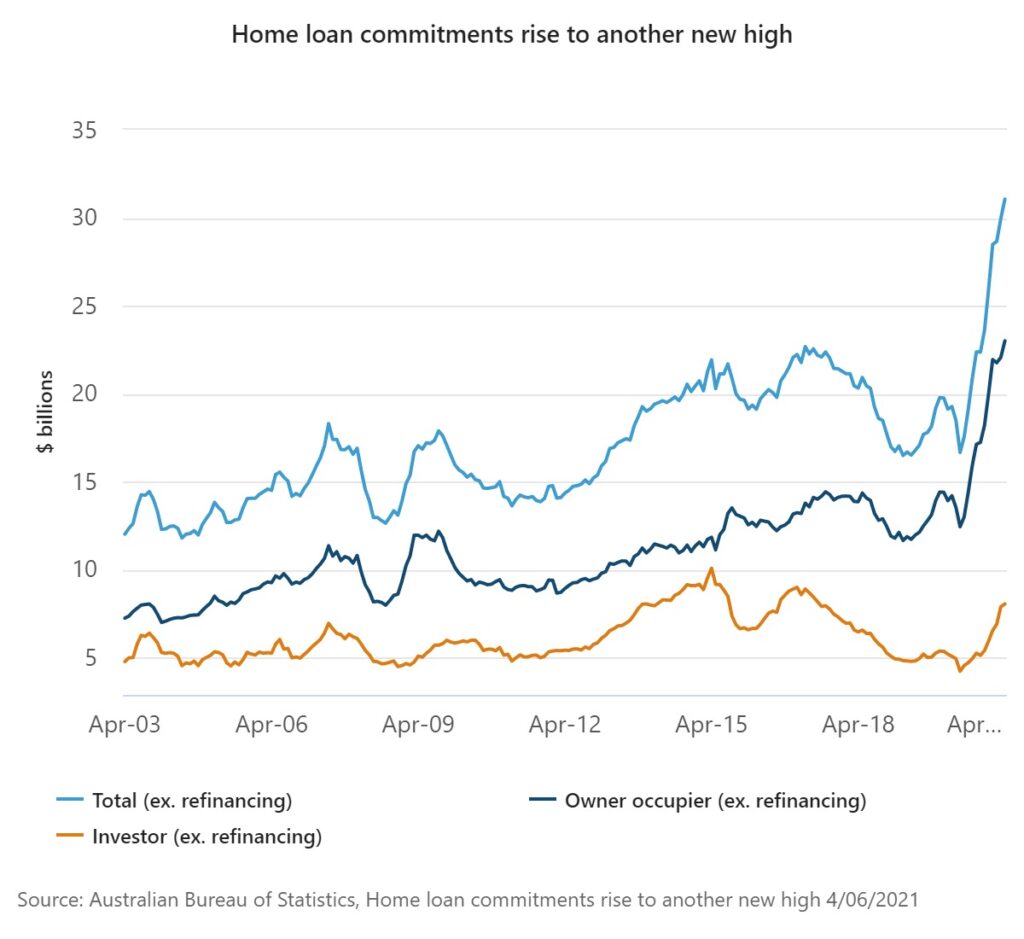

New loan commitments for housing rose 3.7 per cent in April 2021 (seasonally adjusted) to a record high of $31.0 billion according to statistics released today by the Australian Bureau of Statistics (ABS).

ABS head of Finance and Wealth, Katherine Keenan, said: “The value of new loan commitments for owner occupier housing reached another all-time high in April 2021, up 4.3 per cent to $23.0 billion. New loan commitments for investors rose 2.1 per cent to $8.1 billion, which was the highest level since mid-2017.”

“The rise in owner occupier lending was driven by increased loan commitments for existing dwellings, which rose 9.2 per cent. Loan commitments to owner occupiers for the construction of new dwellings fell by 11.4 per cent, following a fall of 14.8 per cent in March. These were the first monthly declines since the Homebuilder grant was introduced in June 2020. However, the value of construction commitments remained at a high level.”

The HomeBuilder grant was reduced from $25k to $15k effective from 1 January 2021 and was closed to new applications from 14 April 2021.

The number of owner occupier first home buyer loan commitments fell 1.9 per cent to 15,171 in April 2021. While this was the third consecutive month of decline, the number of commitments remained at their highest level since July 2009.

n 8.6 per cent rise in New South Wales and an 8.4 per cent rise in Victoria accounted for the majority of the rise in owner occupier housing loan commitments across Australia.

Commitments in Western Australia fell 7.9 per cent, after a fall of 5.1 per cent in March. The Building Bonus Grant which was offered in WA in addition to the federal Homebuilder grant ceased after 31 December 2021.