Goodman’s focus on key logistics locations and the continued demand in online shopping and the rise of the digital economy, has seen the Group deliver strong performance in FY21. The Group delivered operating profit of $1,219.4 million, up 15.0% on FY20, and operating earnings per security (EPS) of 65.6 cents, up 14.1% on FY20.

In addition, robust underlying property fundamentals and investor demand has supported significant growth in revaluations of $5.8 billion across the Group and Partnerships, contributing to the 14% growth in Goodman’s net tangible assets driving statutory profit to $2.3 billion.

Long-term structural trends are well established and are resulting in higher utilisation of space and customer demand for logistics assets.

Customer demand for space continues to increase across a range of industry segments. The prolonged impacts of the COVID19 pandemic continue to accelerate consumers’ propensity to shift to online shopping across the globe with logistics and warehousing critical infrastructure to enable distribution of essential goods to time-sensitive consumers through this period.

In response to the high levels of demand, Goodman have increased the development book to $10.6 billion at June 2021, bring forward significant projects ahead of time. A high-quality workbook with 70% pre-commitments and an average 14 year WALE, allows the projects to be delivered on a yield on cost of of 6.7%. Larger scale, higher value projects have seen average production time increase to approximately 19 months, providing greater visibility over future capital requirements. Notwithstanding this, average annual production rate is approximately $6.6 billion and is expected to remain broadly at these levels through FY22.

Strong revaluations of $5.8 billion across the group has supported growth in total AUM to $57.9 billion. The development WIP will organically grow AUM which is expected to exceed $65 billion in FY22 (up 12%).

Commenting on the outlook, Group Chief Executive Officer, Greg Goodman said “After a robust year in FY21, we expect the current levels of development activity to be sustained over the coming year. The Group is well positioned to maintain WIP of around $10 billion throughout FY22, with multi-storey developments remaining a meaningful contributor.

Goodman remains well-capitalised with available liquidity of $1.9 billion, including $0.9 billion in cash and gearing at 6.8%.

During the year, Goodman also made significant progress on its ESG initiatives including achieving carbon neutrality across the global operations, well ahead of its previous target.

The Group has forecast operating EPS for FY22 at 72.2 cents per security, up 10% on FY21, but will maintain a full year distribution of 30 cents per security in line with the Group’s capital management strategy to maintain an appropriate payout ratio in light of the strong activity levels.

Goodman Group is on our Top Picks List. Whilst the income yield is low, the group is a global market leader in a single sector which is expected to continue to see demand growth in years to come.

The REIT commenced the year with a security price of $14.85 and closed the year at $21.17, providing a 42% gain. The REIT also provided a 30c distribution for FY21, equating to a 2.0% yield, which provide investors with a total return of 44.6%.

Key financial and operational highlights for the period are:

Financial highlights:

- Operating earnings of $1,219 million, up 15% on FY20, equal to 65.5cpu, up 13.9% on the prior corresponding period (pcp)

- Statutory profit of $2,311 million, up 53% om FY20

- Distributions of 30cpu, which is consistent with FY20

- NTA of $6.68 up 14.4% from $5.84 at 30 June 2020

- Balance sheet gearing of 6.8%, down from 7.5% as at 30th June 2020

Operating highlights:

- Total assets under management (AUM) up 12% on FY20 to $57.9 billion

- $5.8 billion of revaluation gains across the Group and Partnership assets combined

- Achieved carbon neutrality across our global operations, significantly increased renewable power useage globally and established a framework for measuring embodied carbon as we move towards carbon neutral developments

- Portfolio maintained high occupancy of 98.1% and like-for-like net property income (NPI) growth of 3.2%

- Development work in progress (WIP) up 63% on FY20, to $10.6 billion, across 73 projects with a yield on cost of 6.7%

- Average Partnership total returns of 17.7% in FY21

Portfolio

Goodman’s business comprises 3 key segments;

- Investments

- Property investment income was down -3.3% due to asset sales largely offsetting underlying rental growth. FX had a $15 million adverse impact relative to FY20. Investments comprise;

- Direct Investments – which comprise 21 properties with a total value of $2.0 billion located primarily in the Sydney market. The direct investments earnt the Group $79.3m in investment earnings in FY21,

- Indirect Investments – Goodman maintains a 26% average equity cornerstone position in Partnerships to ensure alignment and exposure to a high quality globally diversified portfolio. These interests are worth $8.7 billion as at 30th June and earnt the Group $332m in investment earnings in FY21.

- Property investment income was down -3.3% due to asset sales largely offsetting underlying rental growth. FX had a $15 million adverse impact relative to FY20. Investments comprise;

- Development Investments

- Goodman also holds $3.6bn in Development assets (either directly or indirectly).

- The development investments generated $717.9 in earnings in FY21 (up 24%)

- Development earnings growth driven by increased volume but impacted by an FX cost of -$33 million

- Funds Management

- The majority of Goodman’s assets reside in its 16 Partnerships with 49 investor representatives, which are worth $54bn. The business earnt $459m in management earnings from its Partnerships.

- Management earnings down -10% primarily due to timing of performance fees, asset sales reducing base fees (average external stabilised assets were flat for FY21 compared to FY20) and negative $24 million FX impact

Valuations:

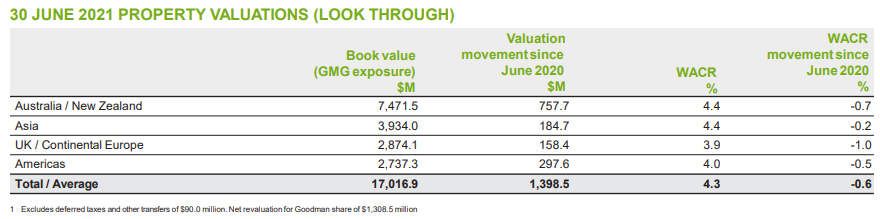

The industrial and logistics asset class is in high demand from both investors and customers and continues to generate positive revaluations. Cap rate compression, development completions within the Partnerships and FX have been drivers of the valuation increase. The global portfolio cap rate has compressed by 55bps to 4.3% over FY21. Revaluation gains across the global portfolio for the year totalled $5.8 billion, with the Group’s share $1,398.5 million as outlined below.

Capital

Goodman’s cash and available lines of credit (excluding Partnership debt and equity) is $1.9 billion as at 30 June 2021. The Groups’ gearing as at 30th June 2021 is at 6.8% (with 17.8% look-through) and consistent with previous guidance, the Group has an ongoing desire to remain in the lower half of the 0-25% Financial Risk Management policy range near-term given the quantity of development being undertaken.

FY22 Guidance

The REIT reconfirms that based on information currently available and barring any unforeseen events or further COVID-19 impacts, FY22 Operating EPS guidance of 72.2 cps representing growth of no less than 10% over FY21 Operating EPS of 65.5cents. In line with the capital and distribution policy, Goodman forecasts an FY22 distribution of 30 cps which equates to a forecast dividend yield of 1.4% based on the closing price as at 1 July 2021 of $21.17.

Trading Chart

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.