Hong Kong-listed ESR is about to become the largest real estate fund manager in Asia Pacific following an announcement today of an agreement to acquire ARA Asset Management for $5.2 billion.

Founded in 2002 and listed on the SGX between 2007-2017, ARA is the largest real asset manager in APAC with a captive and fast growing New Economy real estate platform via its subsidiary, LOGOS. With US$95 billion in gross AUM, ARA operates a diversified multi-product platform across assets, strategies and geographies in both the public and private markets, covering real estate investment trusts (REITs) and private funds in real estate, infrastructure / renewables and credit. It’s stable of brands include an 86% interest in LOGOS, a 30.7% interest in the Cromwell listed REIT, a 30% interest in Japan’s Kenedix REIT and interests in Credit, Private Equity Real Estate, and other Listed REIT Funds.

ARA executes its market leading platform under its “Raise, Invest, Manage and Build” strategy. Group-wide, it has raised over US$16 billion in equity capital since 2016, which has supported a gross transaction volume of acquisitions, divestments and development activity of almost US$20 billion during the same period.

ARA is owned by Warburg Pincus and its founder Lim Hwee Chiang, who together hold 62% of the Group, whilst ESR was co-founded by its senior managers and Warburg Pincus and owned by some of the world’s preeminent investors including the Ontario Municipal Employees Retirement System (OMERS -14.9%), JingDong (JD.com – 7%), APG (6.9%), and SK Holdings (6.4%) as well as Co-founders Charles Portes and Stuart Gibson (via Redwood 14.2%), and Mr Jinchu Shen (via Laurels 10.4%).

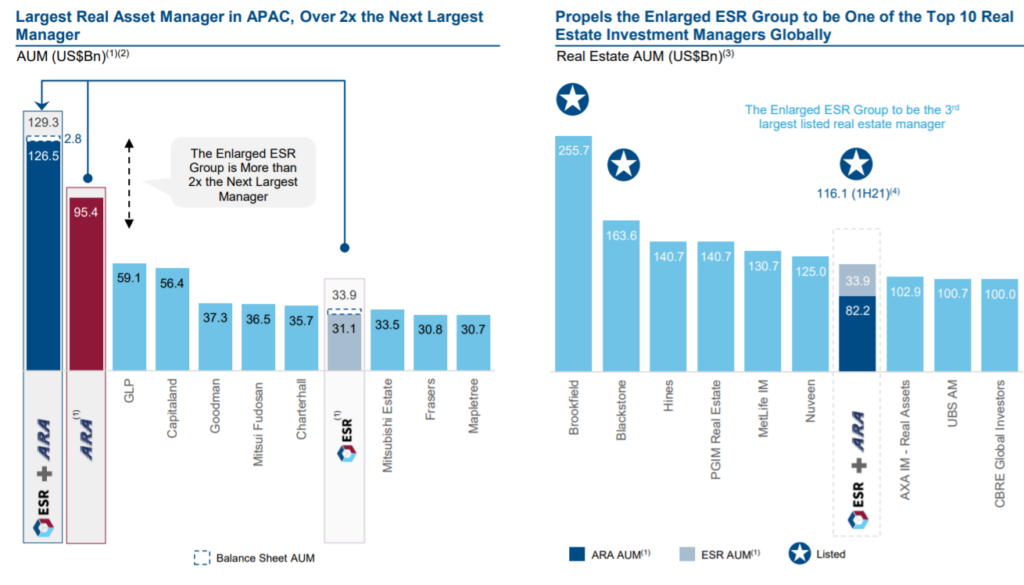

Following the completion of the Transaction, the combined AUM will reach US$129 billion, of which over US$50 billion is in New Economy real estate, making it the largest such platform in APAC. Based on the financial results for 2020, over 80% of the enlarged ESR Group’s EBITDA will come from New Economy real estate, while more than 50% of its AUM will come from

perpetual and core capital vehicles (including 14 listed REITs).

Jeffrey Perlman, Chairman of ESR, said: “Our vision has always been to build a leading fund manager focused on technology enabled real estate, especially logistics and more recently data centres, on the back of major secular trends including the rapid rise of e-commerce, digital transformation and the financialisation of real estate in Asia Pacific. With the acquisition of ARA, we are very excited to bring two best-in-class businesses together to form Asia Pacific’s #1 real asset fund manager powered by the leading New Economy platform. We are currently witnessing a ‘once in a generation’ change in real estate where leading global investors are seeking to rebalance their portfolios by divesting institutional quality assets in order to redeploy that capital back into New Economy real estate where they have been meaningfully underweight. By creating a one-of-a-kind closed loop solutions ecosystem for capital partners with the addition of ARA, we can leverage our perpetual capital vehicles to help them divest these assets and captively redeploy back into New Economy real estate via ESR and LOGOS, the largest New Economy real estate platform in Asia Pacific with over US$50 billion of AUM. As we usher in this new era of real estate, the enlarged ESR Group is even better positioned to capture this outsized market opportunity.”

John Lim, ARA Co-founder and Deputy Chairman, said: “For close to two decades, ARA has established itself as a leading real asset manager with a successful track record across geographies, asset classes and strategies through multiple market cycles. We look forward to partnering with the ESR team, whose expertise, dedication and vision have led to building the region’s leading logistics real estate platform, and we can now together provide investors with a full suite of products with an outsized contribution from New Economy real estate.”

All ARA shareholders will rollover their ownership interest into ESR and have agreed to lock-up of six months. Furthermore, it is contemplated at the close of the transaction ESR’s founders and ARA’s cofounder, John Lim, would have committed to a lock-up of up to 36 months on a staggered basis. The Transaction is subject to ESR shareholders’ approval at an EGM to be convened in due course. The Transaction is subject to customary closing conditions including, amongst others, regulatory approvals. Closing is expected by the end of 2021 or first quarter 2022.

The Key benefits to the acquisition include;

- ESR will become APAC’s Largest Real Asset Manager with a total AUM of US$129Bn

- ESR will be driven by a New Economy Powerhouse with over 50% of AUM and over 80% of EBITDA from New Economy assets, marking the Enlarged ESR Group as APAC’s largest logistics and data center real estate platform

- ESR will be well positioned to benefit from the financialization of real estate in APAC (particularly China, Korea and India) which represents a >US$2Tn opportunity

- ESR will further entrench its capital support with over 60% of revenue contribution from fund management fees and over 50% of AUM in perpetual and core funds, contributing to greater earnings visibility

- ESR will have the Fastest AUM growth among listed real estate asset managers globally and accelerating ESR’s asset light trajectory

- ESR brings together world-class management teams, institutional capital partners and new strategic shareholders to extend leading position in APAC

- Accelerates ESR’s ESG initiatives across portfolio assets, building on established success to lead ESG transformation in APAC

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.