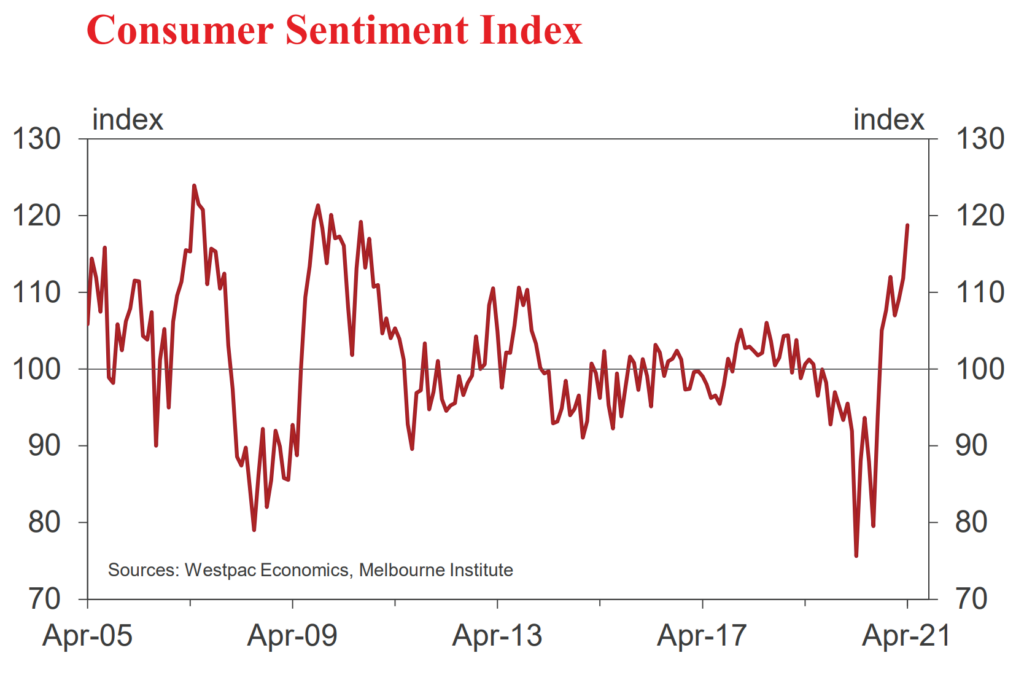

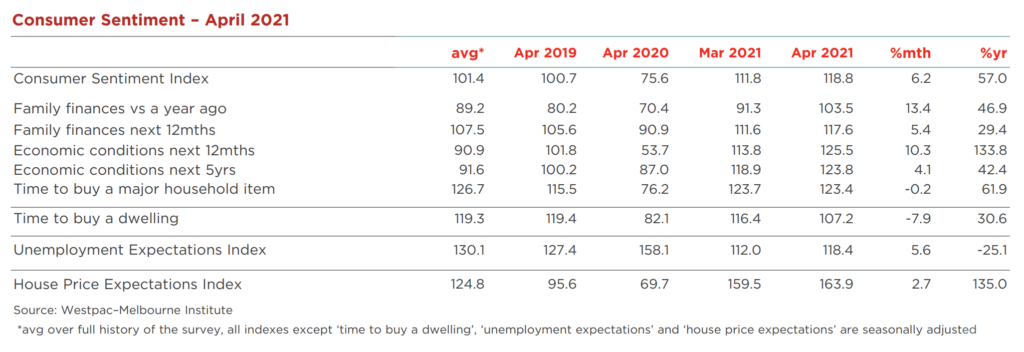

The Westpac-Melbourne Institute Index of Consumer Sentiment has soared to its highest level since the post-GFC mining boom was in full swing back in August 2010.

The Index increased by 6.2% to 118.8 in April from 111.8 in March and surprised Westpac’s Chief Economist, Bill Evans who said “This is an extraordinary result. From my own perspective I considered that there was a reasonable case for the Index to pull back reflecting developments since the March survey”

The survey was conducted in the week following the unwinding of the JobKeeper program and in the midst of disappointing progress on the vaccine roll-out locally. Initial fears that this would slow recovery and extend job losses and undermine confidence have proven to be unfounded.

The survey continues to signal that the consumer will be the key driver of above-trend growth in 2021.

Clearly, confidence would have been buoyed by positive news around the labour market. Job vacancies were reported to be 27% above the pre-COVID level in February last year while the February labour force update showed the unemployment rate had fallen from 6.3% to 5.8% with employment increasing by a stunning 89,000.

The industry breakdown of consumer sentiment provides clues about some less obvious positives at work. Those

employed in the ‘recreational services’ and hospitality industries showed very big sentiment gains (+23% and +14% respectively), suggesting the further easing in COVID restrictions – which has allowed many businesses in these sectors to return to near full operation – were a big positive factor. This result is particularly pertinent given that the unwinding of JobKeeper was expected to disproportionately impact recreation and hospitality.

There were also big sentiment gains amongst those working in construction (+17.3%), including tradies (+18.5%) and labourers (+14.6%) suggesting the surge in housing construction activity is also providing a significant uplift.

The strong housing market more generally is also likely to be boosting confidence. Auction clearance rates are near 80% and dwelling prices have lifted by 5.8% nationally since the beginning of the year.

Despite the increasingly positive news around jobs, the Governor of the Reserve Bank confirmed, following the latest Board meeting, that he expects to hold the cash rate steady at the record low of 0.1% until at least 2024.

When the Index was last at these levels, in August 2010, the Reserve Bank had increased the cash rate by 150 basis points to 4.5% from its GFC low of 3% in September 2009. That sharp increase in rates is likely to have contributed to the Index falling 25% over the following year. No doubt the Reserve Bank will be aware of that period and continue to tread carefully with the cash rate.

The Reserve Bank Board next meets on May 4 – one week before the Federal Budget.

Bill Evans said “We expect the Board to maintain current policy settings. It is also likely to confirm that there is no immediate intention to intervene in the housing market using the macro-prudential-style measures seen in 2015 and 2017.”

Westpac expects that approach to change by the middle of 2022 as the authorities respond to further increases in prices and a likely lift in investor activity – in line with the signals emerging from this month’s survey.

Bill Evans said “Markets will focus on the revised forecast for the path of the unemployment rate following the sharp improvement in the recent data. There is likely to be a downward recalibration in the RBA’s forecast path for the unemployment rate but the Bank also appears to have lowered its estimates of the full employment rate.”

“The net effect will be consistent policy guidance that it will still be some time – 2024 at the earliest – before the Bank expects to achieve its full employment and inflation targets. The faster likely improvement in the labour market will be offset by the more challenging target for the full employment rate.”

Further Information

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.