Charter Hall Upgrades Earnings Guidance on 7% growth in FUM

12 November 2020

Charter Hall continues to enjoy strong support from capital partners and has upgraded its earnings forecast with investment capacity now standing at $6.5bill.

The group has now recovered to be just -1.2% below the previous high of $14.03 per security in February 2020. By comparison, the ASX 200 AREIT Index remains -14% below the February peak, weighed down by the heavy exposure to the retail sector.

Since June 30, the Charter Hall has raised a total of $1.8 billion, with successful raising activity in the Charter Hall Prime Industrial Fund (CPIF), Charter Hall Long WALE REIT (ASX:CLW), the creation of a new Wholesale Partnership with Dutch pension fund PGGM and continued on-going inflows to the Direct suite of funds.

The Group continues to find opportunities to deploy capital in Industrial and Logistics, Long WALE Retail and Social Infrastructure that are consistent with our long WALE investment mandates and meet

our capital partners target IRRs.

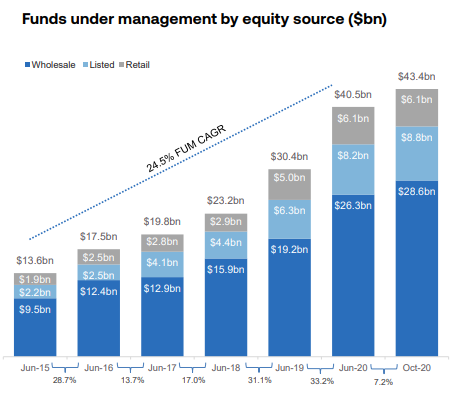

Group FUM has gorwn by 7.2% to $43.4 billion following this equity raising and deployment activity.

In light of this activity, based on no material change in current market conditions and assuming the COVID-19 operating environment does not deteriorate from here, the Group upgrades FY21 earnings guidance to post-tax operating earnings per unit of approximately 53 cents from previous guidance of 51 cents. Distribution per security guidance remains unchanged at 6% growth over FY20.

Managing Director and Group CEO, David Harrison said, “We have enjoyed another strong start to the year, with on-going support from our capital

partners and clear endorsement of our Long WALE investment strategies. Our partnership approach has also made us a compelling choice for tenants. This has seen us continue to build our sale and leaseback portfolio,

further extending existing relationships, while establishing new ones. It’s also very pleasing to be able to announce our new partnership with PGGM and we look forward to building this into another successful long-term strategy.”

Since 30 June, the Group has conducted $3.4 billion of gross transactions with $2.7 billion of net acquisitions.

Acquisitions were heavily skewed to sale and leaseback transactions across the platform with a mix of new and existing tenant partners. Highlights in the period included Ampol, bp New Zealand, Visy and the QUBE Minto acquisition.

The Group continues to progress a number of off-market opportunities across all sectors, looking to utilise its sale and leaseback expertise and continue partnering with tenants for mutual advantage.

Transaction activity continues to reflect the on-going investment demand for Industrial & Logistics, Long WALE Retail and Social Infrastructure exposure. Office transactions across the market have continued to track below historical averages. Despite this, strong offshore interest continues to

be seen for Australian office in the key Sydney and Melbourne markets and the Group expects office transaction pricing will remain firm and reflect the large gap between office yields and the 10-year bond rate.