Centuria Industrial REIT’s Vals Increase by $192m in Q3 FY21

26 March 2021

Australia’s largest listed pure-play industrial fund, Centuria Industrial REIT (ASX: CIP), today announced its total portfolio value increased within the March quarter by $192million to $2.6billion on a like for like book value basis.

Of its 61 industrial assets, 56 were independently valued resulting in healthy increases in capital values and overall capitalisation rate compression across the portfolio, which is evident from recent market transactions.

During FY21 to date, CIP transacted $757million worth of industrial assets, which alone generated a $64million uplift towards its total portfolio revaluation gain.

The weighted average capitalisation rate (WACR) tightened 46 basis points from 5.42% to 4.96%.

Subsequently, proforma Net Tangible Assets (NTA) increased from $2.99 to $3.32 per unit.

Jesse Curtis, CIP Fund Manager, commented, “Currently, Australia’s industrial property market is experiencing a substantial re-rate, attracting significant investment demand from both domestic and international capital.

“Major transactions in the market continue to show capitalisation compression, complemented by strong tenant demand from e-commerce and a scarcity of investment grade assets.

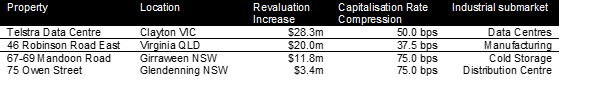

Key valuations movements include:

The CIP portfolio has a healthy 9.8-year Weighted Average Lease Expiry (WALE) and a 97.7% occupancy.

Curtis concluded, “With evidence of continued major transactions in the industrial sector expected, CIP’s is well positioned to be a major beneficiary of the strong performing Australian industrial market.”

Our Views

The Cap rate compression in the portfolio is significant and a reflection of the amount of capital looking for assets in the sector. The risks of softening of cap rates from this point looks greater, particularly as bond yields look set to rise over the longer term.

The market has accepted the uplift and the units are now trading at NTA.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.